The real estate industry has been in the news a bit lately. Not so much about the trends and home values. More so about class action lawsuits, which have stolen a lot of attention away from the positive activity that is happening in our market. While the lawsuit is an important story to track, one critical item to mention is that WA has already complied with the majority of what the proposed lawsuit settlement is suggesting.

New laws went into place on Jan 1, 2024, that complemented changes our MLS started making in 2019. We have been smooth sailing for almost four months bringing heightened transparency to every real estate transaction we do with new laws, forms, and procedures. The national hype has caused a stir, so before I get into the three important trends, I wanted to let you know that WA is ahead of the curve. If you have any questions on how to distinguish the national headlines from the local truth, please don’t hesitate to contact me.

INFLATION: Interest Rates & Insurance

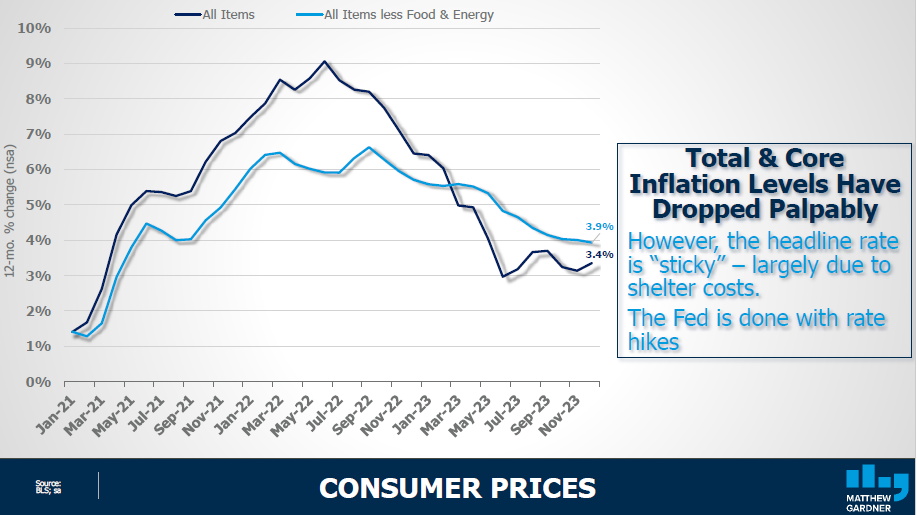

Inflation has been a hot topic for a few years now. We all know the cost of groceries, gas, and everyday items are higher than they were just a few years ago. This caused interest rates to increase in spring 2022, hovering between 6.25-7.5% over the last 2 years. Despite these rate increases we have watched the real estate market and home values recover and start to appreciate again. The median price in Snohomish County is up 5% in Q1 2024 over Q1 2023 and up 13% in King County. The spring market has sprung!

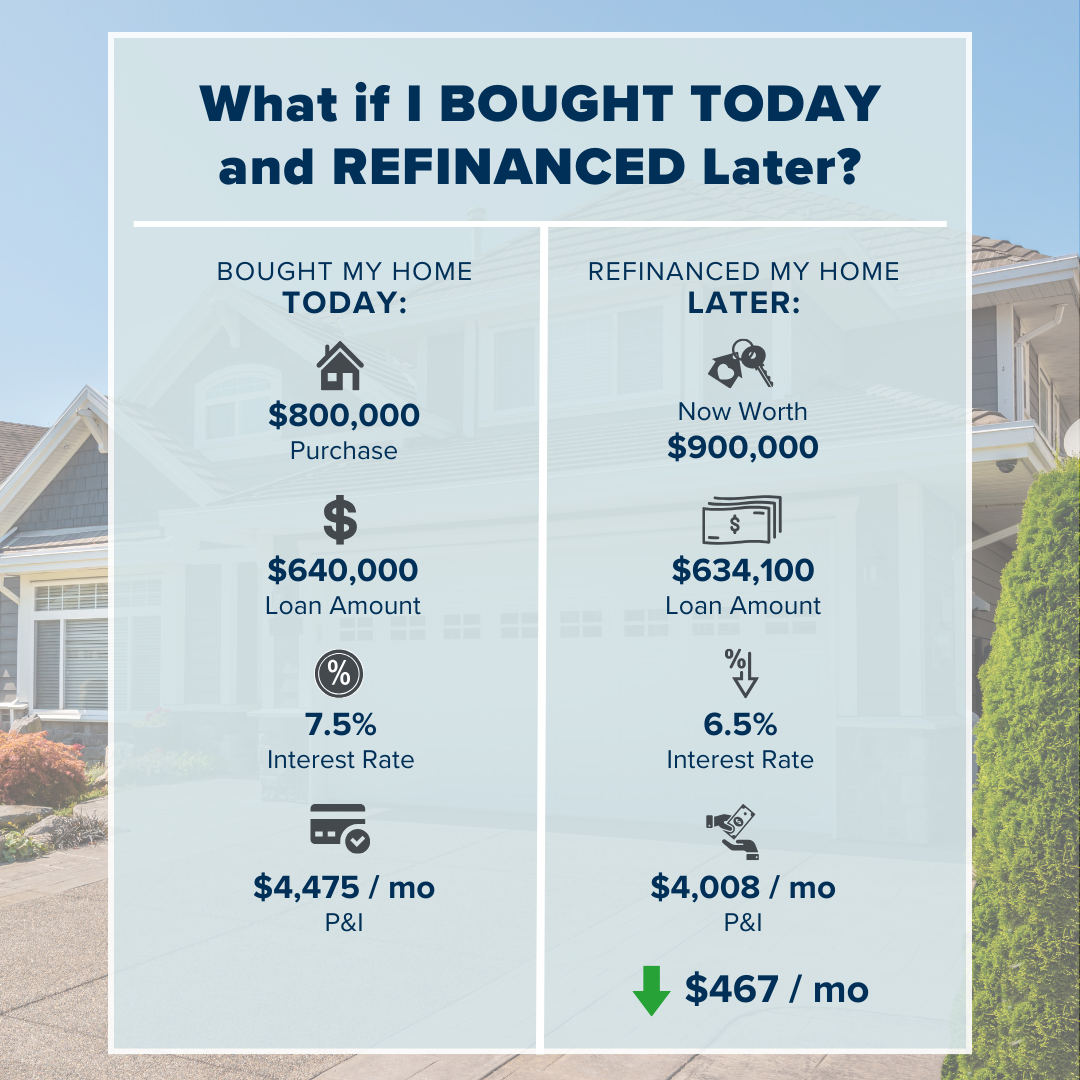

The lending costs to purchase a home have increased and it has limited and sidelined some buyers. However, many are finding ways to make it work and demand is strong with the return of multiple offers and price escalations on well-priced and presented listings. If you are waiting for rates to come down, also pay attention to prices as it is a delicate balance of affordability. The option to re-finance your interest rate down the road if rates dip will decrease your monthly payment while keeping your loan balance fixed.

Homeowners Insurance has also been hit hard by inflation and a heightened amount of claims over the last four years. Natural disasters such as fires, floods, and earthquakes have depleted many insurance companies’ reserves causing them to re-calibrate their rates across the board to keep up. You may have seen an increase in your rate. With home values and goods on the rise, it is important that you have your home and belongings adequately insured.

I’d suggest you check in with your carrier to make sure they have your home and your belongings properly valued. With market dynamics quickly shifting I’d caution you from grabbing your home value from an online estimator such as Zillow or your insurer’s automated program. Those algorithms are most often inaccurate which could leave you under-insured. I’m happy to help you assess the current value of your home in today’s market so you can properly calibrate your homeowner’s insurance in this volatile insurance environment.

HOME EQUITY Movement:

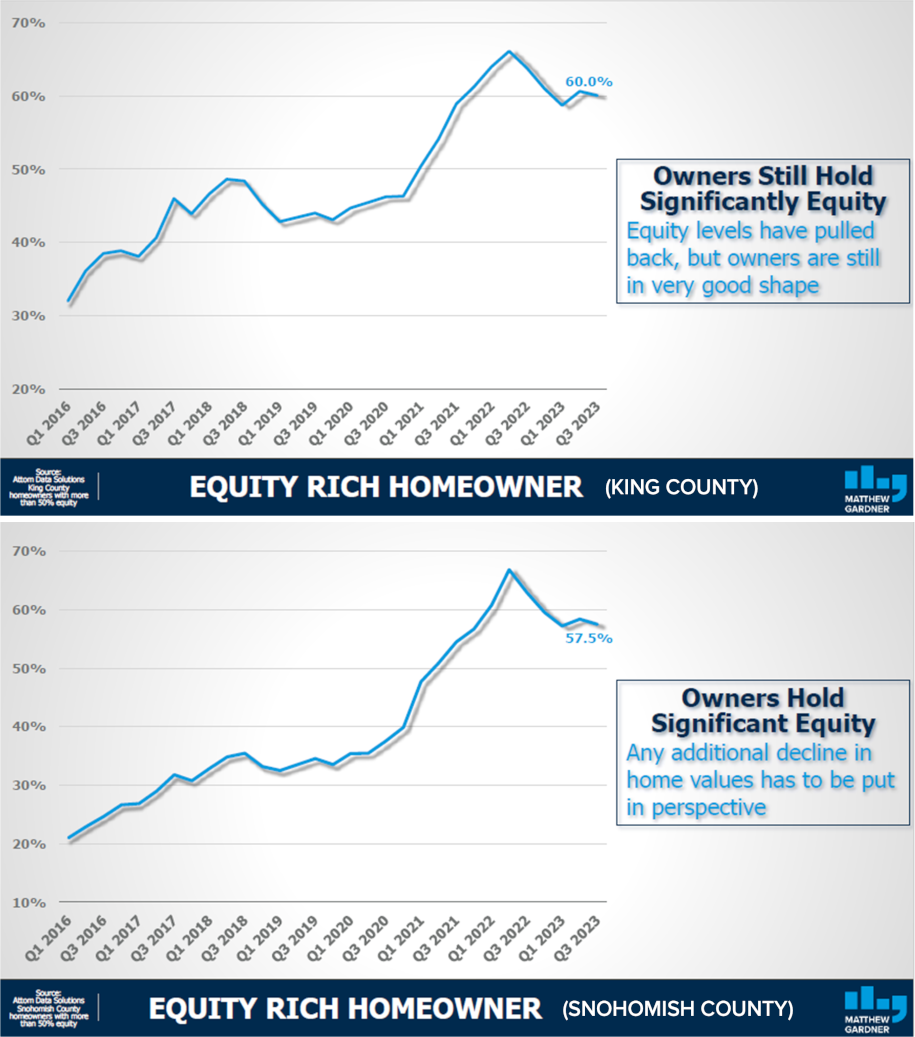

According to ATTOM data, 67.4% of homeowners in the U.S. have at least 50% home equity, with 38.7% owning their homes free and clear. Locally, the average homeowner in Snohomish County has 57.5% home equity, and in King County 60%. Those local figures were reported in Q4 2023 and we have seen a jump in values since then indicating that those figures are now higher.

The point is that home equity is strong for many homeowners, which allows homeowners who are looking to make a move to use creative options to make those moves smooth. We are in a competitive seller’s market so trying to purchase a home contingent on the sale of your current home is a challenging feat. At Windermere, we have the awesome Windermere Bridge Loan Program (WBLP) that helps people tap into their equity to make their next purchase instead of having to sell their homes first.

The WBLP does not require an appraisal like a Home Equity Line of Credit (HELOC), is quickly approved, and does not require monthly payments. The loan balance and any accrued interest are paid off when the collateral property is sold, allowing buyers who are also sellers to easily utilize their equity and not have to move twice. I’ve even seen the collateral property close first if strategized properly. This eliminates having to fund the Bridge Loan altogether, yet it was used to make that buyer’s offer competitive and helped them win the house for their next chapter in life.

HOME PREPARATION Overwhelm:

One of the biggest tasks I assist clients with is preparing their homes for the market. How a home comes to market can make a huge difference in the bottom line. Remedying deferred maintenance, making home improvements, remodeling, clean-up, purging, and merchandising can all contribute to a seller making more money on closing day. Creating a punch list of items that will create the most favorable return is a service I provide my clients.

Identifying the available funds, hiring service providers, and just getting started can cause overwhelm and sometimes paralysis. As stated above, many homeowners have amazing home equity. Leveraging home equity can help a homeowner complete the projects that will make a better profit! At Windermere, we have the Windermere Ready Program (WRP) which allows home sellers to tap into their equity before coming to market to get their homes market-ready.

Like the WBLP, the WRP is quickly approved, does not require an appraisal, and monthly payments are not required. We figure out which projects we want to focus on, gather bids from trusted contractors, create a budget, and apply. The funds are provided within 2 weeks and we can line up the work and start the transformation immediately.

I’ve seen simple flooring replacements and fresh paint transform a house. We’ve even done a full kitchen remodel to completely change up the vibe. The projects that warm my heart are helping elderly sellers sort through years of living and clearing the space for potential buyers to envision themselves in the home. Did you know that there are companies that help people sort and purge their belongings, so they are prepared to move on to their next chapter? Lastly, we can solve property issues with the WRP! Earlier this year, we discovered a failed septic system on a listing and we were able to utilize the WRP to tackle that fix and made it to the closing table at top dollar.

Markets are fast-paced and dynamic! Helping clients navigate the environment to protect their investment, strategize financing, and/or prepare their property are tasks that I take very seriously. Even if it is as simple or complicated as clearing a house for the market. Whether we are evaluating these items for an immediate move or we are planning out years in the future providing this care matters to me! Please reach out if you or someone you know are curious about how the trends relate to their situation. It is my mission to help keep my clients well informed to empower strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

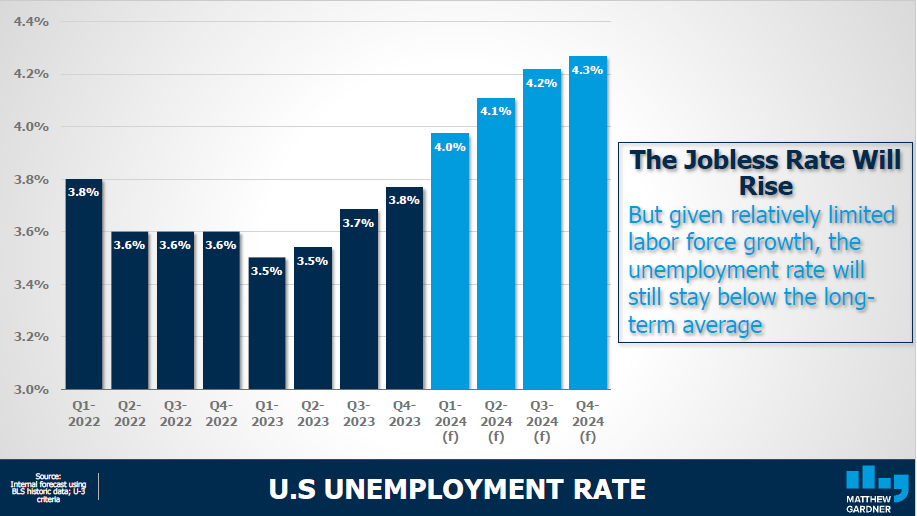

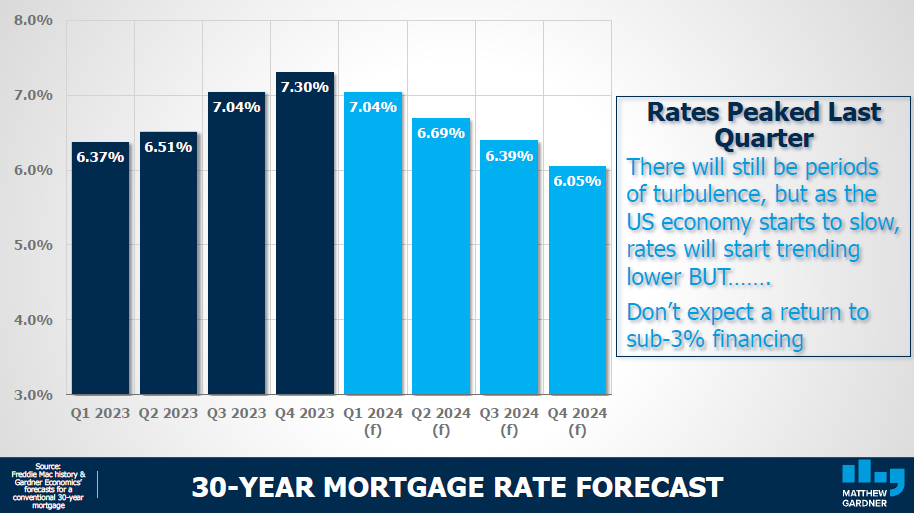

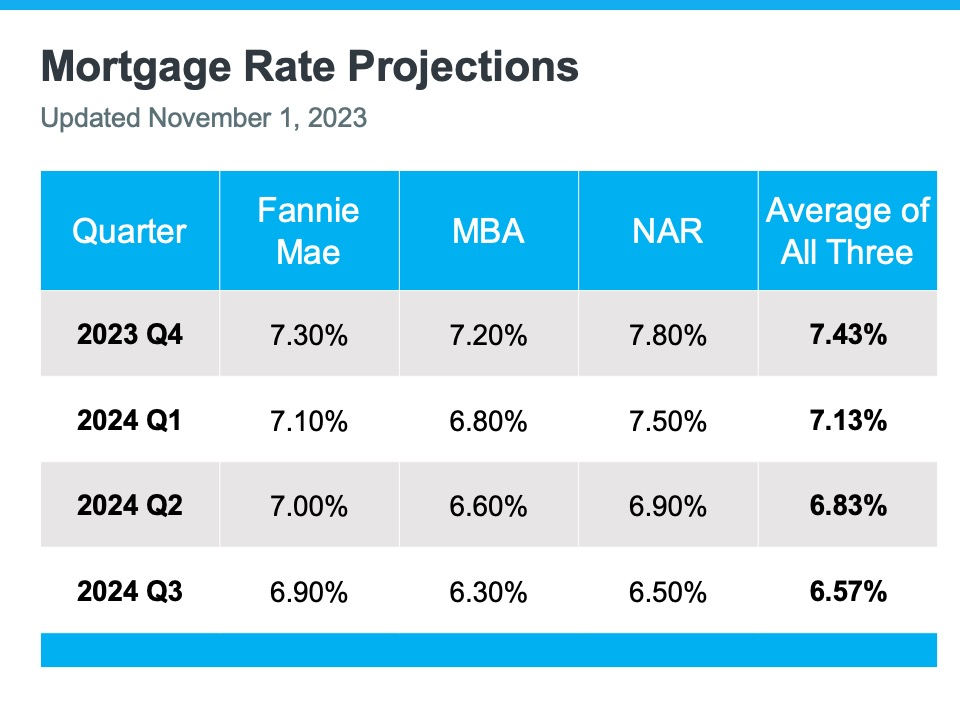

The story of 2023 was balancing interest rates with home purchases and even home sales. The average weekly rate in 2023 was 6.8% and peaked in October at 7.94%. This caused some buyers to pause due to cost. Many sellers were reluctant to move and give up their low payments based on historically low rates, hence the large decrease in new listings in 2023.

The story of 2023 was balancing interest rates with home purchases and even home sales. The average weekly rate in 2023 was 6.8% and peaked in October at 7.94%. This caused some buyers to pause due to cost. Many sellers were reluctant to move and give up their low payments based on historically low rates, hence the large decrease in new listings in 2023.

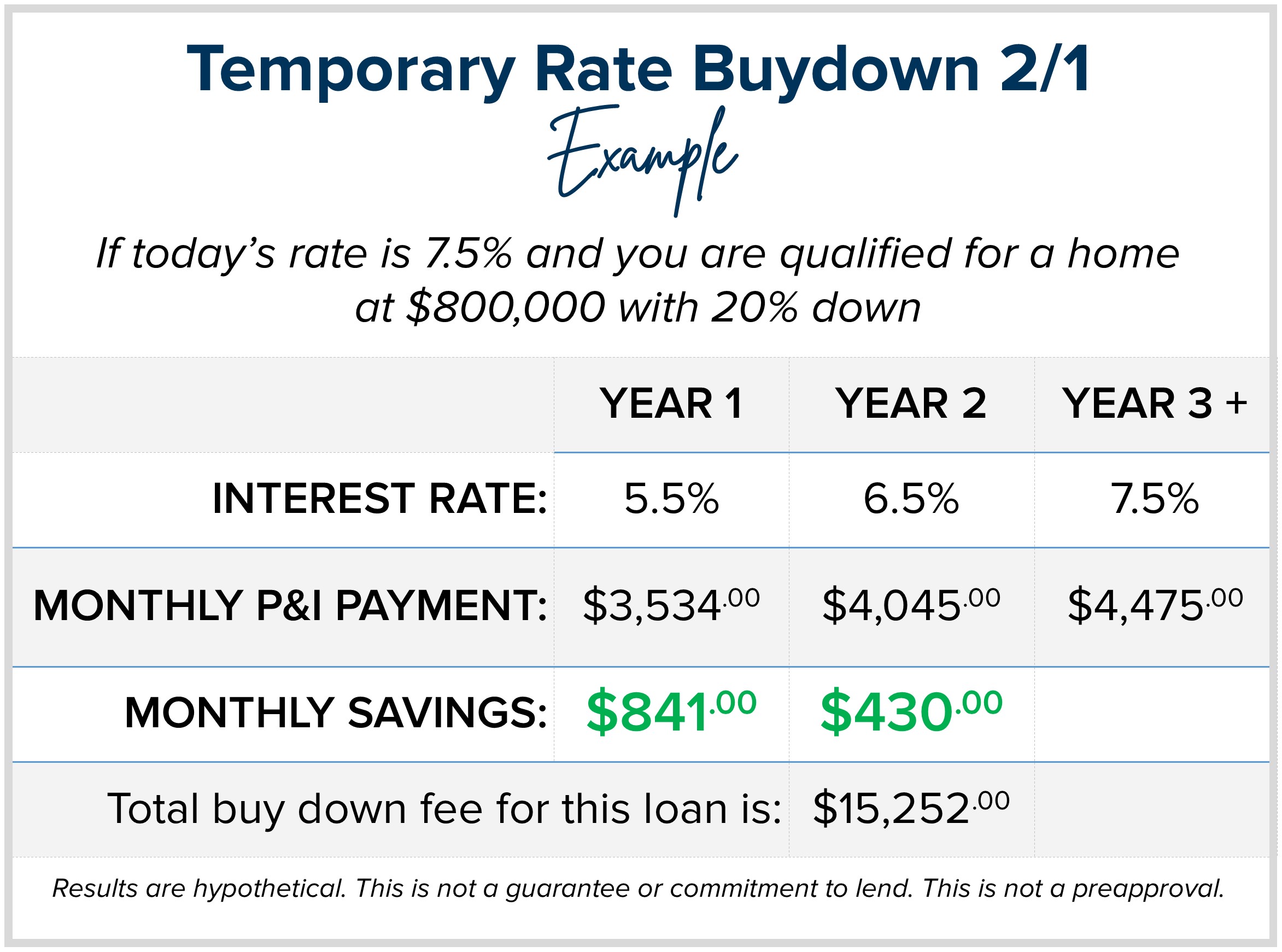

The question that many potential buyers are asking themselves right now is: should I wait for rates to drop before I buy? Higher interest rates have certainly made monthly payments higher and challenged overall affordability, however it is important to consider creative financing options and what the impact on prices will be once rates lower.

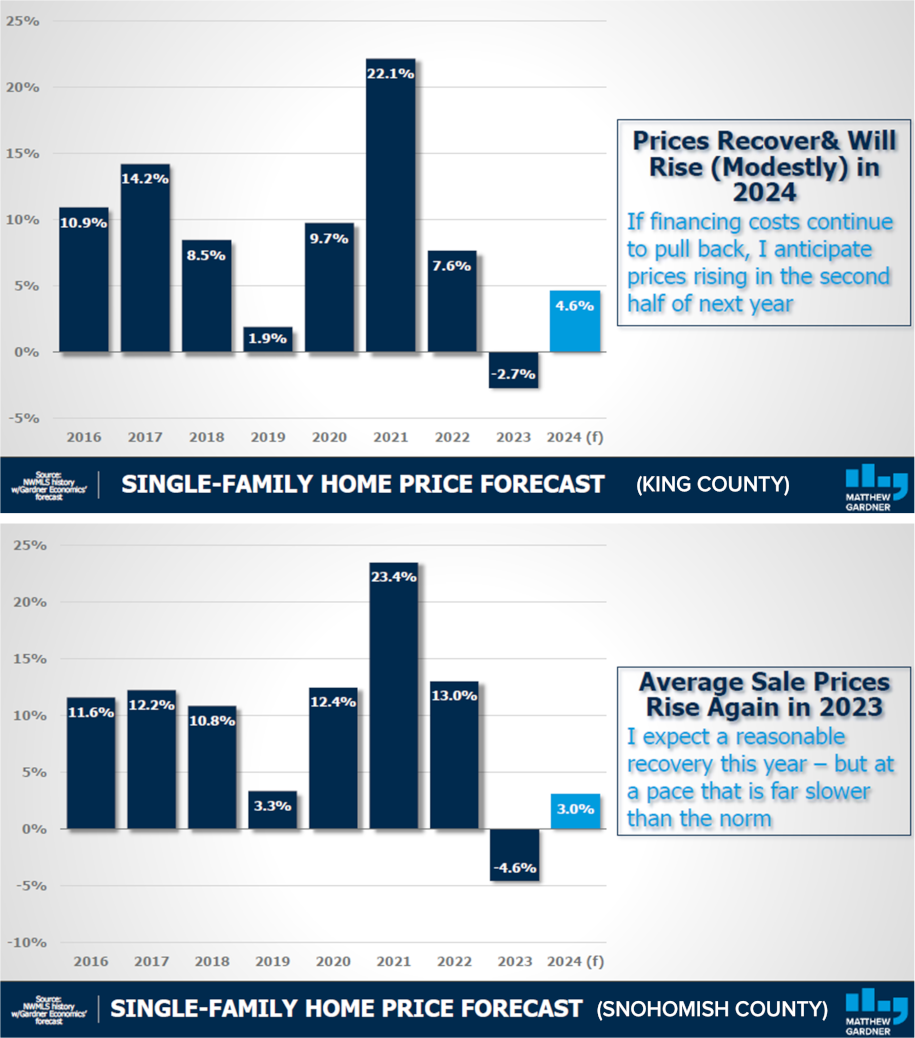

The question that many potential buyers are asking themselves right now is: should I wait for rates to drop before I buy? Higher interest rates have certainly made monthly payments higher and challenged overall affordability, however it is important to consider creative financing options and what the impact on prices will be once rates lower. Just like the correction that happened in 2022, it is safe to say there is a correlation between prices and rates. If the experts are correct and rates fall over the course of the next year or so, we should anticipate prices to increase. That is what hangs in the balance when making the decision of whether to buy now or later. The example to the right shows the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

Just like the correction that happened in 2022, it is safe to say there is a correlation between prices and rates. If the experts are correct and rates fall over the course of the next year or so, we should anticipate prices to increase. That is what hangs in the balance when making the decision of whether to buy now or later. The example to the right shows the effect that price appreciation will have despite rates being lower. It was not that long ago that we were experiencing bidding wars where homes escalated in the double digits. As you can see, the higher price results in a higher payment even with the lower rate.

You see, there are many options to consider when a buyer is balancing rates, prices, payments, and their desire to make a move. I understand that I am in the business of helping people navigate big life changes while ensuring their financial investment is sound. I felt it was an important message to share these examples in case you or someone you know was thinking about making a purchase but was feeling confused or stifled by the current rate environment. If you want to learn more or need a referral to a reputable lender, please reach out. It is always my goal to help keep my clients well-informed and empower strong decisions.

You see, there are many options to consider when a buyer is balancing rates, prices, payments, and their desire to make a move. I understand that I am in the business of helping people navigate big life changes while ensuring their financial investment is sound. I felt it was an important message to share these examples in case you or someone you know was thinking about making a purchase but was feeling confused or stifled by the current rate environment. If you want to learn more or need a referral to a reputable lender, please reach out. It is always my goal to help keep my clients well-informed and empower strong decisions.

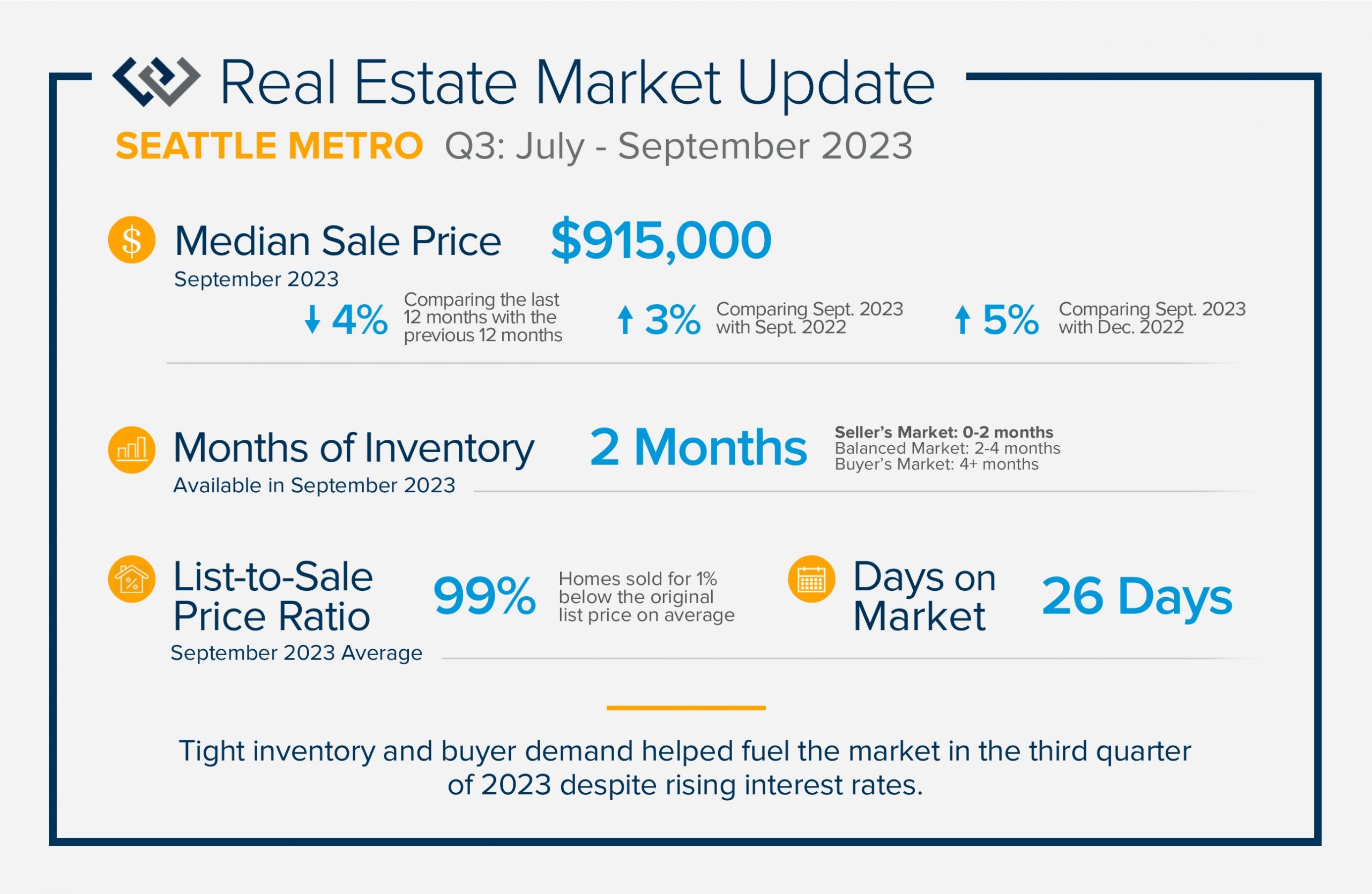

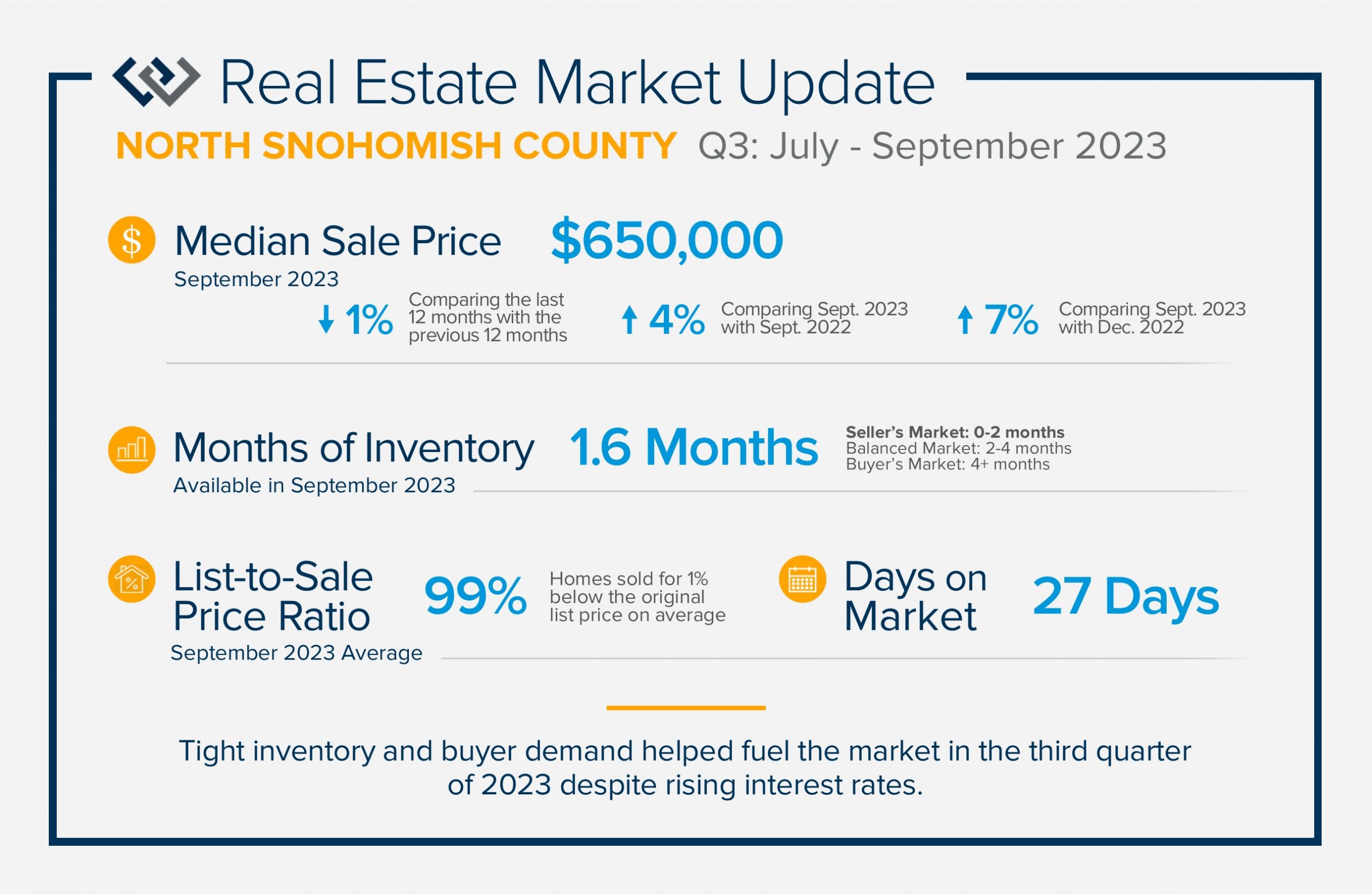

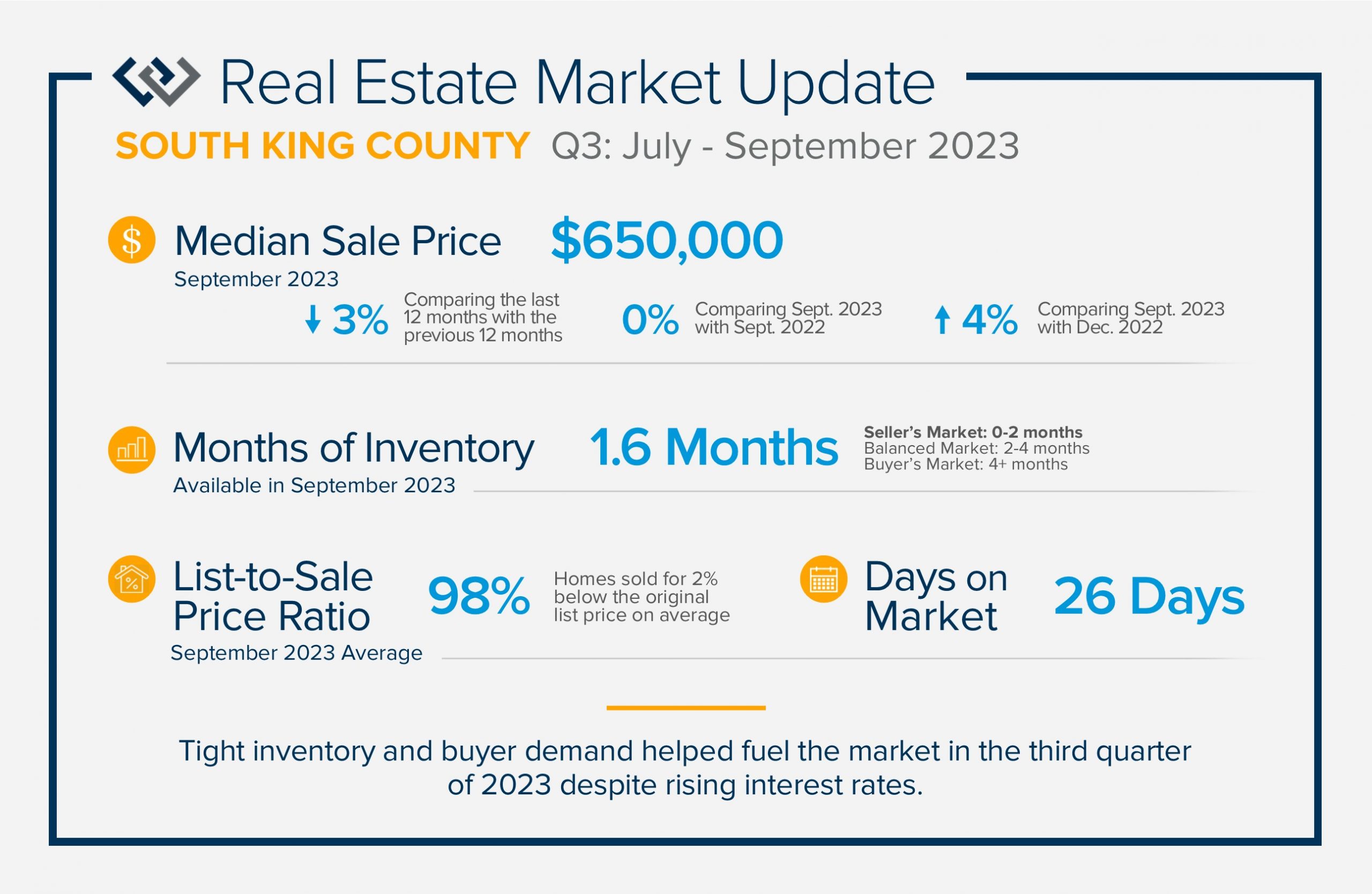

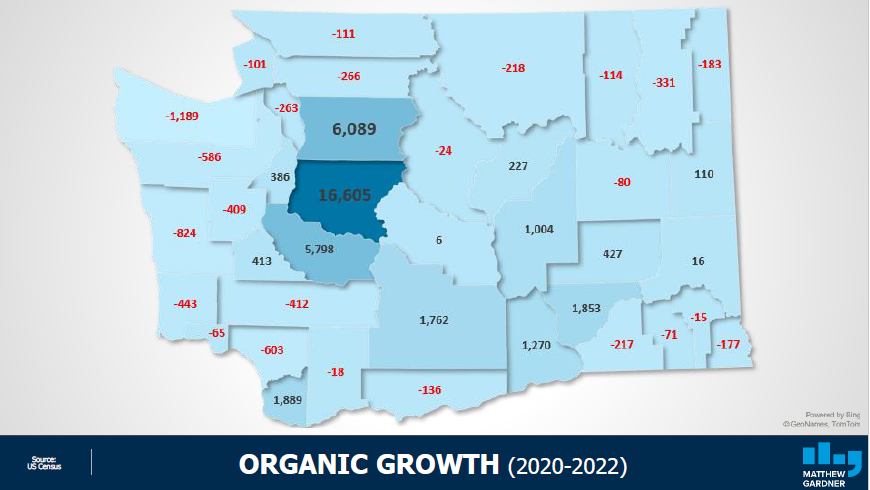

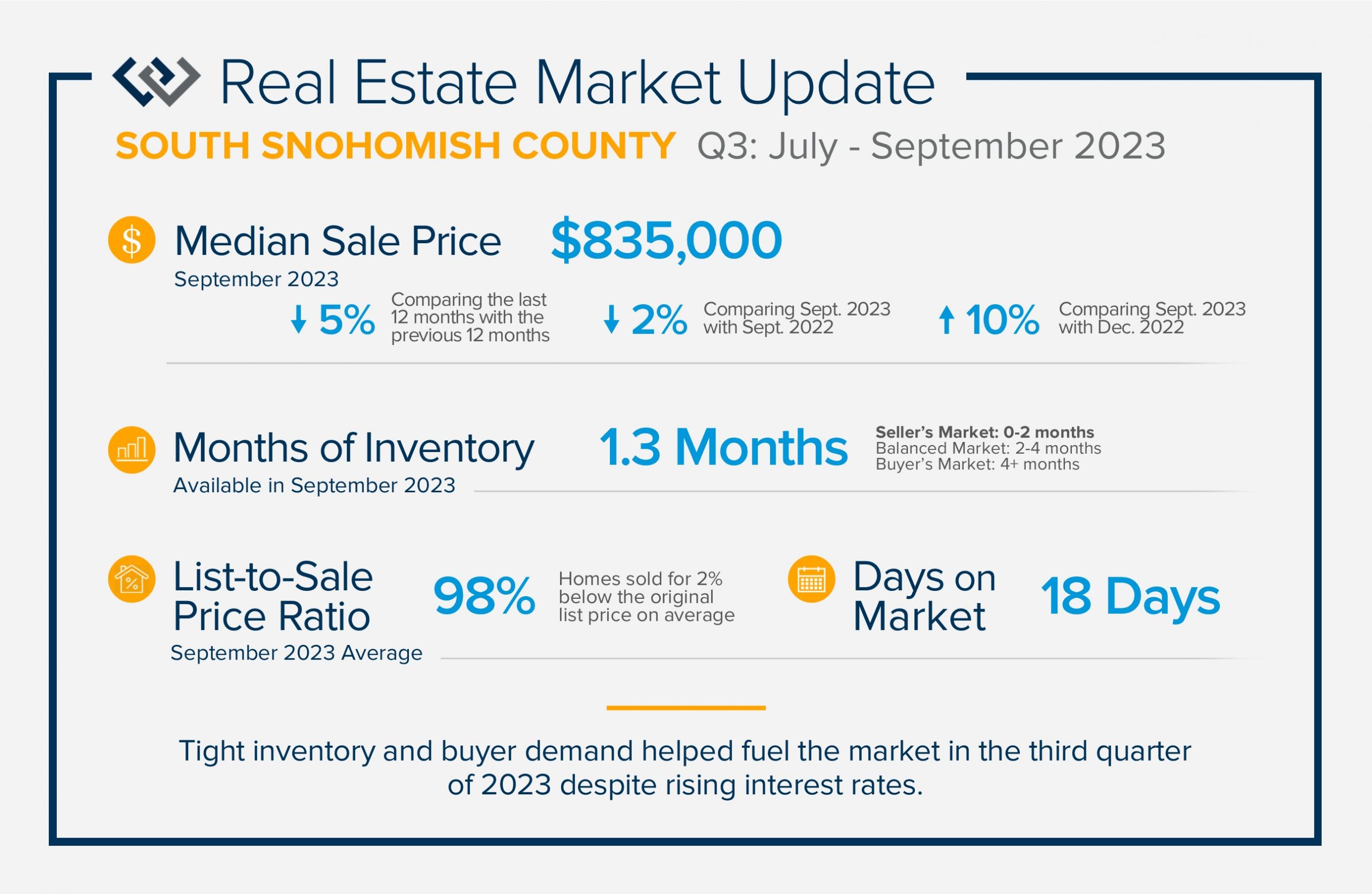

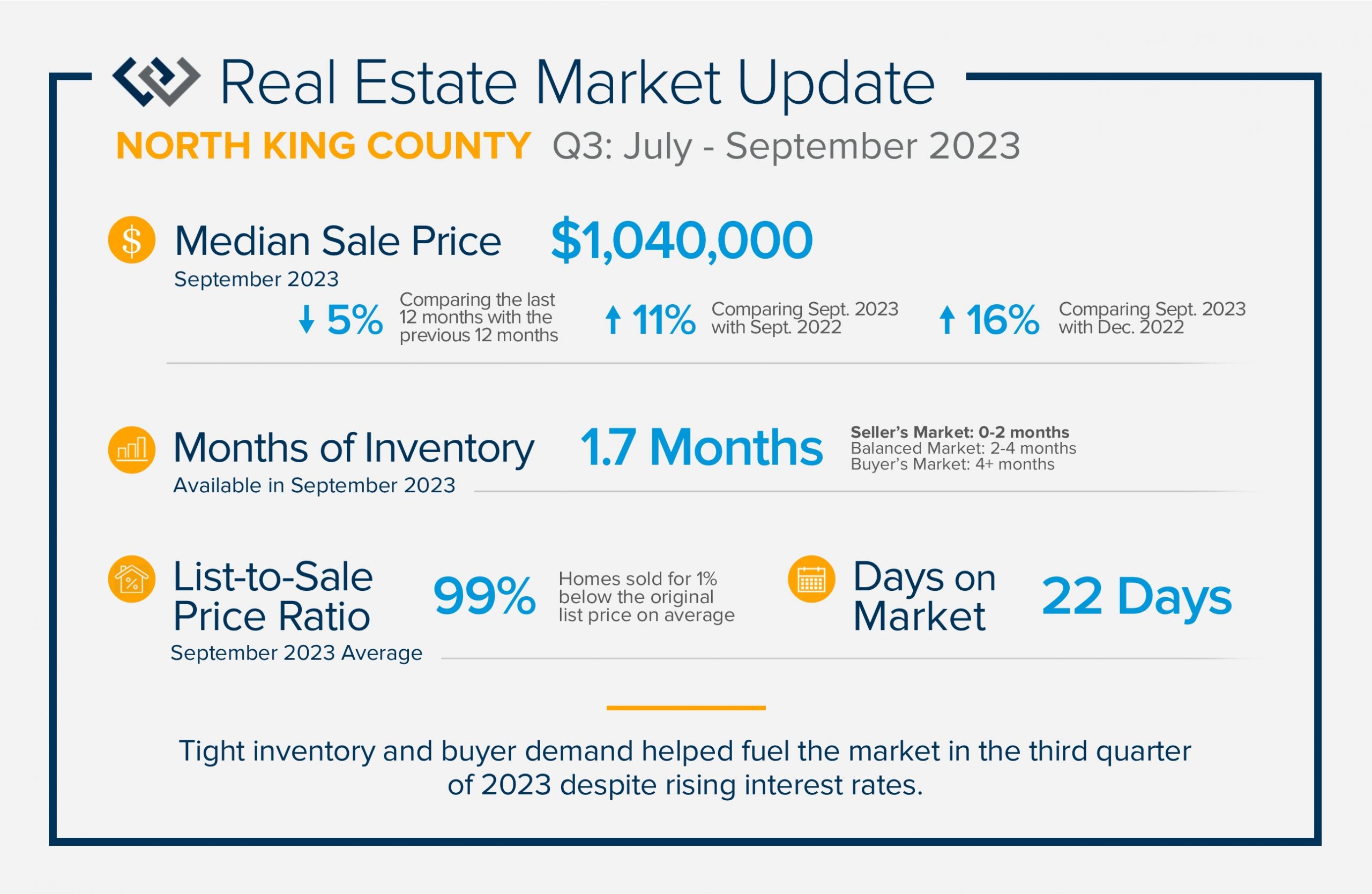

Tight inventory and buyer demand helped fuel the market in the third quarter of 2023 despite rising interest rates. There have been fewer listings in 2023 than in 2022 which has created price growth since the first of the year. Prices peaked in spring 2022, corrected in the second half of 2022, and then they started to rise again in 2023. Home equity is high with over 50% of all homeowners having 50% or more equity in their homes.

Tight inventory and buyer demand helped fuel the market in the third quarter of 2023 despite rising interest rates. There have been fewer listings in 2023 than in 2022 which has created price growth since the first of the year. Prices peaked in spring 2022, corrected in the second half of 2022, and then they started to rise again in 2023. Home equity is high with over 50% of all homeowners having 50% or more equity in their homes.