The headlines are swirling about the real estate market. The environment is shifting from a seller’s market to a balanced market, creating opportunities for buyers and holding sellers to exacting standards. The primary factors affecting this shift are inventory levels, interest rates, and consumer confidence. These are the same factors that commonly influence the market conditions, and for the first time since 2018, months of inventory have reached their highest peak. Interest rates have remained stubborn, hovering around 7% for the last six months, and the stock market drama in April took a toll on consumer sentiment.

The headlines are swirling about the real estate market. The environment is shifting from a seller’s market to a balanced market, creating opportunities for buyers and holding sellers to exacting standards. The primary factors affecting this shift are inventory levels, interest rates, and consumer confidence. These are the same factors that commonly influence the market conditions, and for the first time since 2018, months of inventory have reached their highest peak. Interest rates have remained stubborn, hovering around 7% for the last six months, and the stock market drama in April took a toll on consumer sentiment.

The good news is that the stock market has fully recovered from the April decline; however, the residual effects are likely to have some lasting impact on consumer confidence as they plan their financial decisions. Other good news for buyers is the increase in selection, which allows for more negotiations and can provide the option of a buyer credit. In King County, there were 62% more homes for sale in May compared to the same month last year, and 33% more than in April. In Snohomish County, there were 48% more homes for sale in May compared to the same month last year, and 32% more than in April. It is also important to note that each sub-market, established by price point, location, and property type, can vary. We are currently seeing a mix of sellers’, balanced, and buyers’ markets across the region as inventory increases.

We surveyed our office’s pending sales over the last two months, and one in three transactions had a buyer credit, with an average credit of $14,000. This is where a credit to the buyer from the seller is baked into the contract. Often, this accompanies a full-price offer (from the list price), and sometimes the offer is below the list price. These credits are used to offset the buyer’s closing costs, which leaves more money in the buyer’s pocket post-closing for improvements, a larger down payment, or savings. We are also seeing savvy buyers use these credits to buy down their interest rate, thereby saving on their monthly payment.

A permanent rate buydown requires approximately 3% of the purchase price to lower the rate by one point for the 30-year term of the loan. A good rule of thumb to remember is that every 1-point decrease in rate equals a 10% increase in buying power. For example, if the rate is 7% and you are qualified for a home at $800,000, and the rate were to decrease by 1 point to 6%, you could now afford $880,000 with a very similar payment. Another way to look at this is simply the monthly payment itself. An $800,000 purchase with 20% down and a 6% interest rate would save a buyer $420.82 a month compared to the payment at 7%.

A permanent buydown is a valuable tool, as is a temporary buydown. It is one of the most powerful tools in today’s market. It costs far less than a permanent buy-down. Here is an example: let’s say you are shopping for a house and have an $800,000 budget, along with a 20% down payment (btw, this works for any down payment amount), given today’s interest rate of 7%. The monthly principal and interest payment would be $4,257.94. You could do a 2-1 buydown (2 points lower in year one and 1 point lower in year 2), which would have your payment in year one be based on an interest rate of 5% with a monthly principal and interest payment of $3,435.66 – a savings of $822.28 a month. For year two, the monthly principal and interest would be based on 6%, resulting in a monthly payment of $3,837.12, a $420.82 savings. The total savings in monthly payments with the 2-1 buy-down over the two years would be $14,917.18.

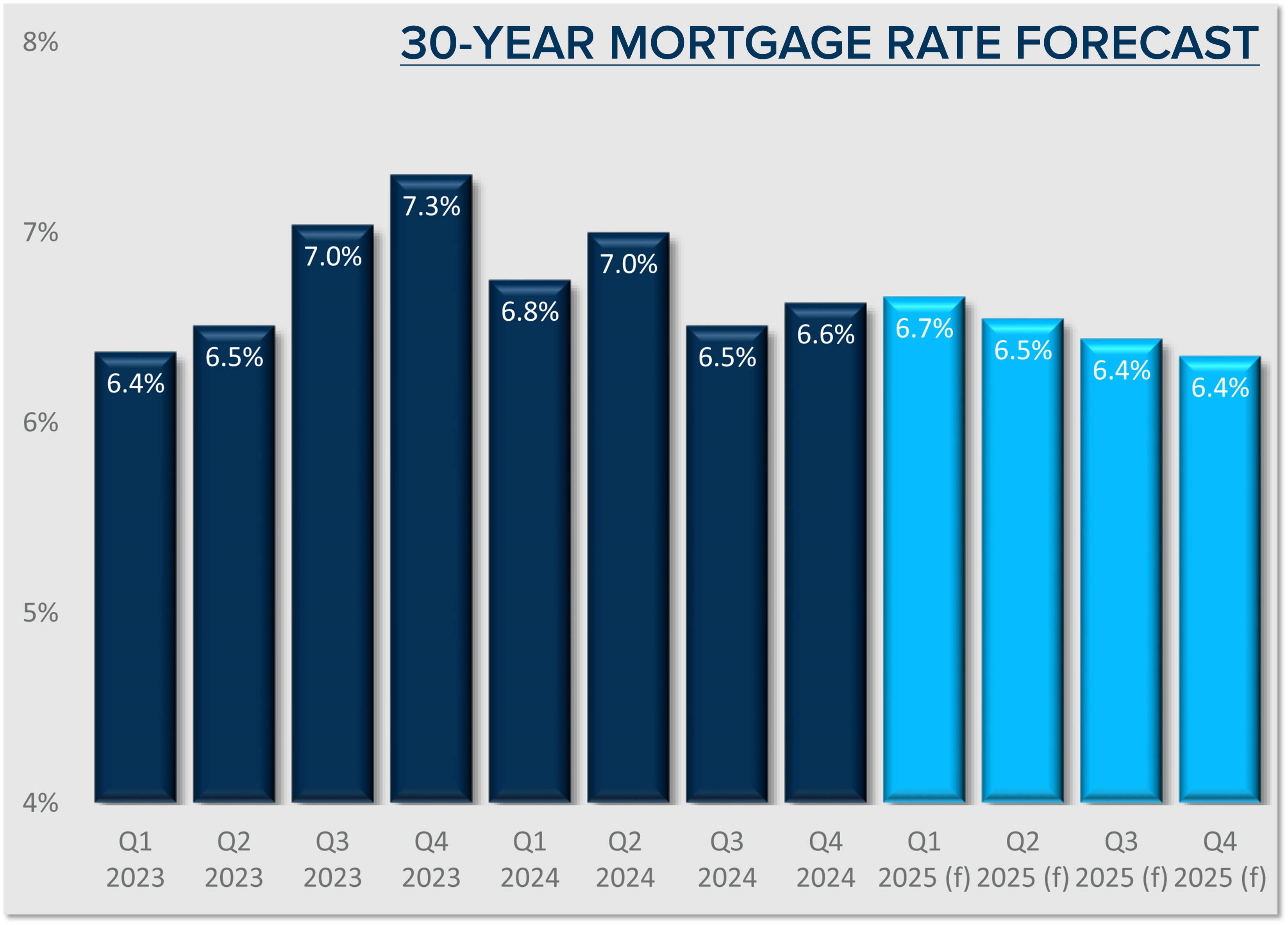

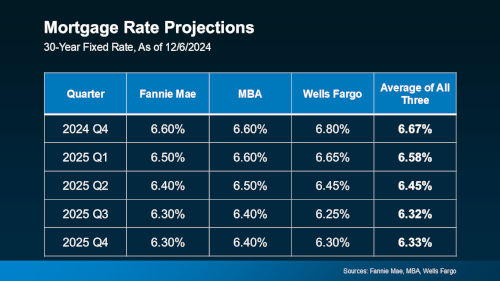

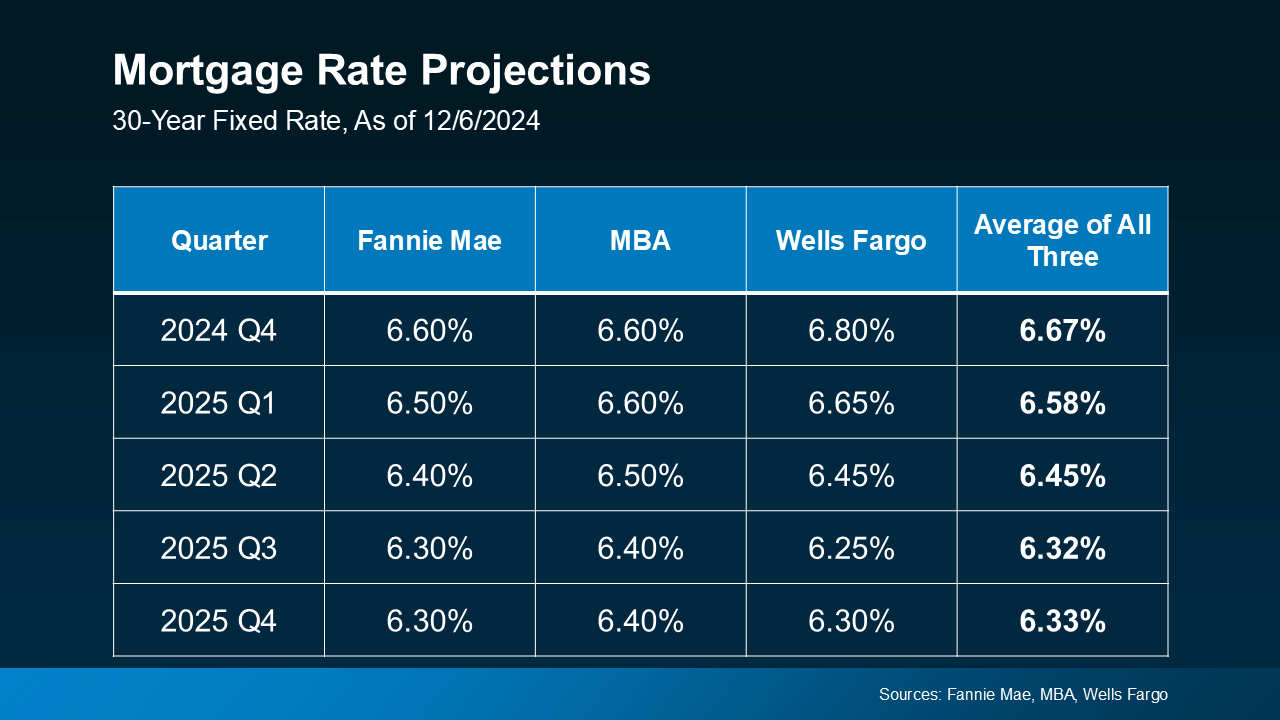

The roughly $15,000 in monthly payment savings is paid upfront at closing and can be provided as a buyer credit by the seller. The buyer still needs to qualify based on the 7% interest rate, as the payments will be converted to those based on the 7% rate in year three and moving forward. The buyer may never have to pay the 7% amount if rates decrease and they can refinance within the two years, permanently locking in a rate below 7%. A bonus is that if the entire $15,000 credit has not been used yet, in some cases, those unused funds can be applied towards the refinance. The latest expert rate predictions are below. While we don’t have a crystal ball to predict when this will happen, I do know that when it does, there will be more buyer competition in the market, which will affect negotiations.

A peculiar aspect of consumer sentiment is that when there is more inventory and the market becomes more balanced, as opposed to a tight market where buyers are competing for limited choices, it confuses buyers. They tend to slow down and think something may be wrong. Savvy buyers will zero in on a house they want and use this time to negotiate better terms for due diligence and possible credits, rather than escalating prices and accepting no contingencies that often occur in a seller’s market. Another benefit to a balanced market is the return of home sale contingencies. This balance of inventory is necessary to introduce this option, and it has been quite a while since we’ve seen this happen. Although they are not commonplace, they are on the rise. This enables the buyer to purchase contingent on the successful sale and closing of their current home. It was how real estate used to be done, and a great option if all lines up.

Now, how does this increase in inventory affect sellers? As mentioned above, it raises the bar on property preparation, accurate price positioning, and overall appeal. When there are more choices, you need to stand out! That is why homes that meet these criteria continue to sell for more than their list price and receive multiple offers. Homes that are brought to market, neutralized, staged, free of deferred maintenance, and appropriately priced are selling quickly. If a home has modern improvements, that helps too, as many buyers prefer move-in condition as they are often using the bulk of their savings for a down payment to create the lowest possible monthly payment.

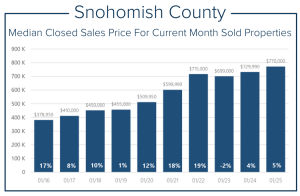

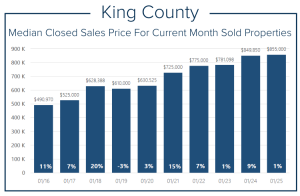

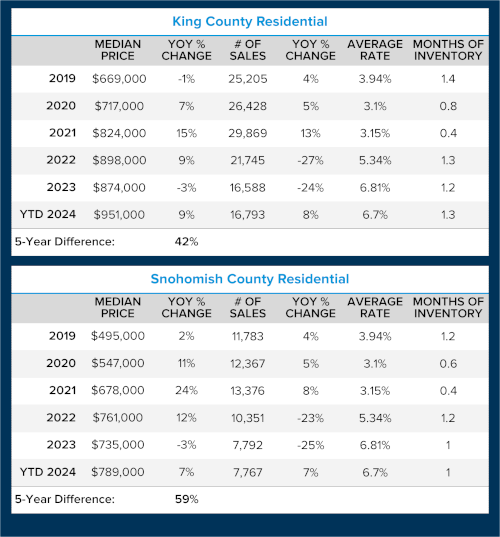

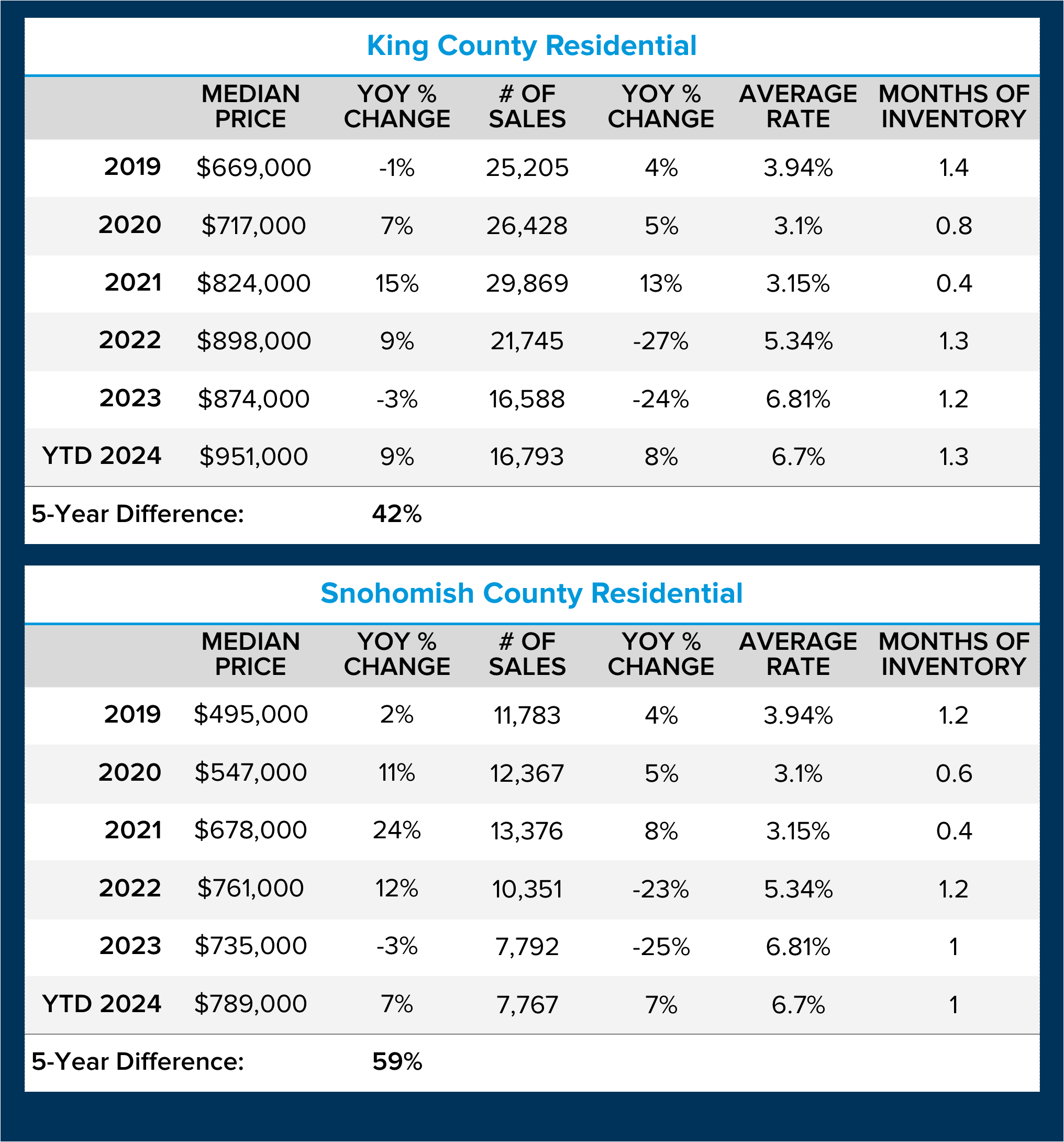

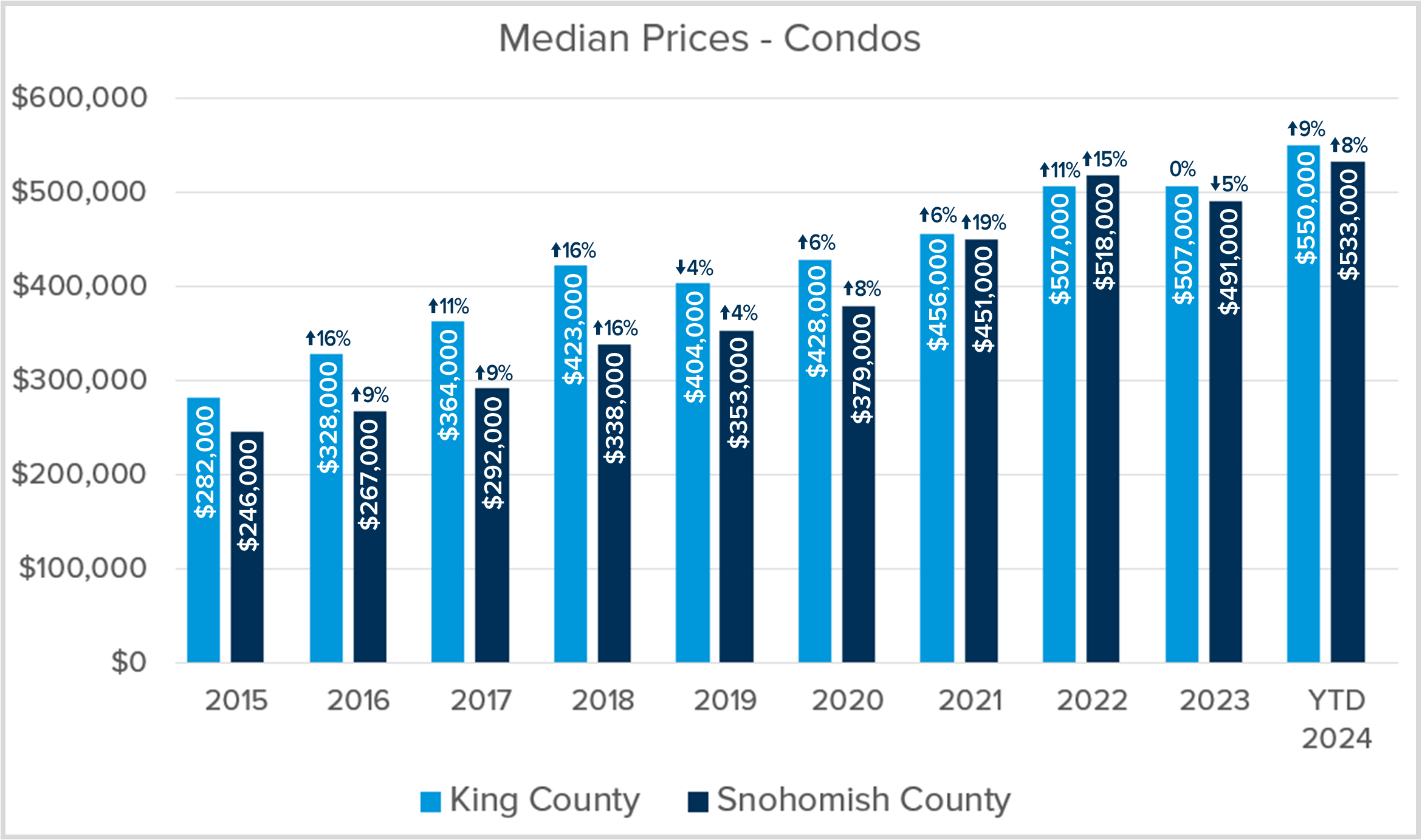

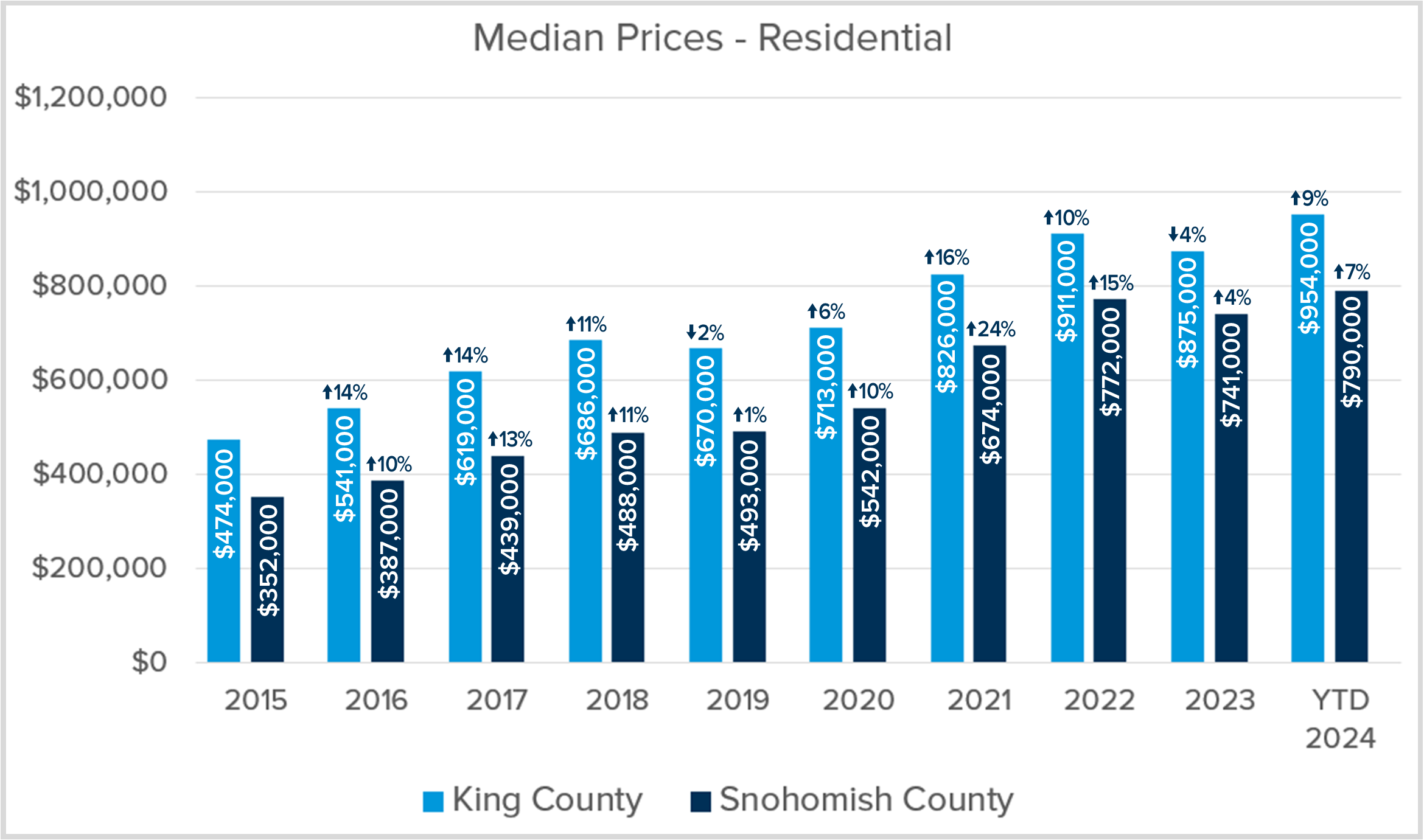

So, what is appropriate price positioning? I will start with the big picture first. Sellers must maintain a long-term perspective and assess their equity growth during their ownership. Single-family residential prices in King County have increased by 91% over the past decade and by 44% over the past five years. Single-family residential prices in Snohomish County have increased by 113% over the past decade and by 52% over the past five years. Sellers have made remarkable gains, and success should not be measured by the froth of a seller’s market, but by the gains of a sale in any market. The big-picture approach often leads to a smooth and profitable transition from one house to the next.

Now, back to the tactics of price positioning. Annual prices typically peak in the spring, and after reviewing the latest May 2025 figures, it appears we have hit the peak for the year. This is about 30-45 days earlier than in 2024 and previous years. Additionally, year-over-year prices are flat and slightly down from 2024, so sellers should consider this when choosing their price with their broker. This, along with the increase in selection, means that sellers need to determine the value point at which a buyer is willing to make an offer when they have more choices. They cannot price based on last year’s market, which had different environmental factors.

One thing we can always count on in life is change. The real estate market is no different. In the case of our local real estate market, this change sits on the shoulders of monumental growth. There is always an opportunity within the change, and staying close to the data helps unearth this. I’m encouraged by the balance in the market and look forward to helping my clients navigate their life transitions in the most effective way possible. Research, data, and listening to my client’s goals are the backbone of my approach. If you or someone you know is experiencing significant life changes that a move could help with, please reach out. We can discuss the big picture, apply the data, and chart a custom plan together. It is always my goal to help keep my clients well-informed and empower them to make strong decisions.

June Home Maintenance 🏡✨ Pest-proofing your home indoors and out is important not only for your health and happiness, but also to prevent lasting damage to your home. From insects like mosquitoes or wasps to rodents, preventing pests from sharing your home will be an expense well-worth budgeting for.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Last week, my office hosted a panel discussion on the hot topic of homeowners insurance. In the wake of several natural disasters, supply chain issues, and inflation on building materials, homeowners insurance is currently experiencing a “hard market”. Non-renewal and cancellation rates are rising, some carriers are leaving certain states, and specific aspects of a home, like wood-shake roofs, are being more scrutinized. This has caused coverage to increase in cost and, in some cases, not be available. We assembled this panel to get this critical real-time information in front of our clients, so they can adequately care for their home(s).

Last week, my office hosted a panel discussion on the hot topic of homeowners insurance. In the wake of several natural disasters, supply chain issues, and inflation on building materials, homeowners insurance is currently experiencing a “hard market”. Non-renewal and cancellation rates are rising, some carriers are leaving certain states, and specific aspects of a home, like wood-shake roofs, are being more scrutinized. This has caused coverage to increase in cost and, in some cases, not be available. We assembled this panel to get this critical real-time information in front of our clients, so they can adequately care for their home(s).

If you or someone you know has any vegetable starts or seeds that you would like to donate to my office’s annual Community Service Day project, please reach out!

If you or someone you know has any vegetable starts or seeds that you would like to donate to my office’s annual Community Service Day project, please reach out!

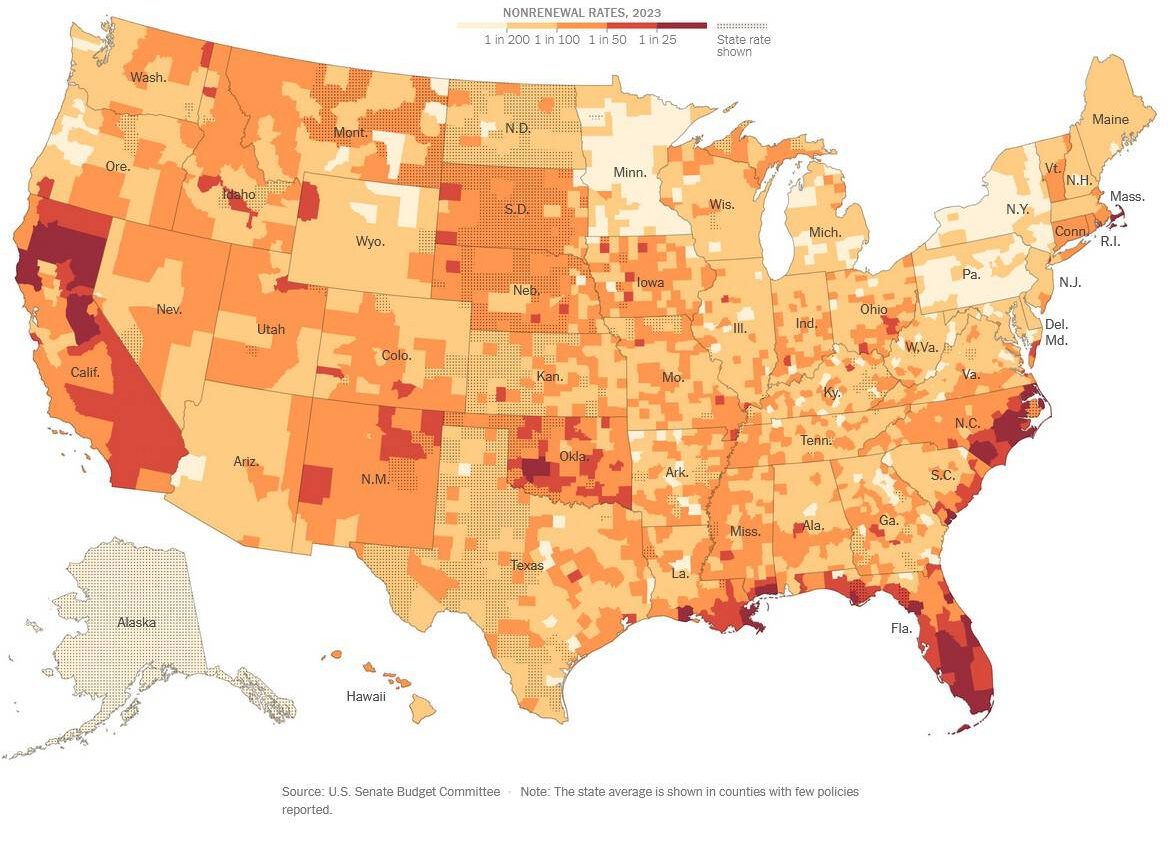

As your trusted real estate advisor, my service to you is beyond the transaction of buying and selling real estate. Your home is your nest egg and often your most significant financial investment, requiring care and attention to maintain and protect it. An important aspect of protecting your home is your Homeowners Insurance Policy. In the wake of several natural disasters over the past five years, insurance carriers have depleted their reserves and had to recalibrate their risk management plans. Carriers have mitigated their risk by analyzing which areas of the country have the highest likelihood of claims, as well as which consumers have the highest claim rates.

As your trusted real estate advisor, my service to you is beyond the transaction of buying and selling real estate. Your home is your nest egg and often your most significant financial investment, requiring care and attention to maintain and protect it. An important aspect of protecting your home is your Homeowners Insurance Policy. In the wake of several natural disasters over the past five years, insurance carriers have depleted their reserves and had to recalibrate their risk management plans. Carriers have mitigated their risk by analyzing which areas of the country have the highest likelihood of claims, as well as which consumers have the highest claim rates. Furthermore, some carriers are revising their policies, including the states in which they will operate and the products and materials they will insure. For example, in 2025 Safeco/Liberty Mutual will stop writing new policies for condominium, renters, and watercraft insurance in the state of California. This month, they are also capping umbrella limits to $1 million in some states, forcing renewals to lower that level if they had a higher coverage amount. No company is immune to these effects, so it is important to explore your options for the most complete coverage. It is also essential to review all mail from your insurance providers as renewals approach, so you don’t miss any significant changes.

Furthermore, some carriers are revising their policies, including the states in which they will operate and the products and materials they will insure. For example, in 2025 Safeco/Liberty Mutual will stop writing new policies for condominium, renters, and watercraft insurance in the state of California. This month, they are also capping umbrella limits to $1 million in some states, forcing renewals to lower that level if they had a higher coverage amount. No company is immune to these effects, so it is important to explore your options for the most complete coverage. It is also essential to review all mail from your insurance providers as renewals approach, so you don’t miss any significant changes.

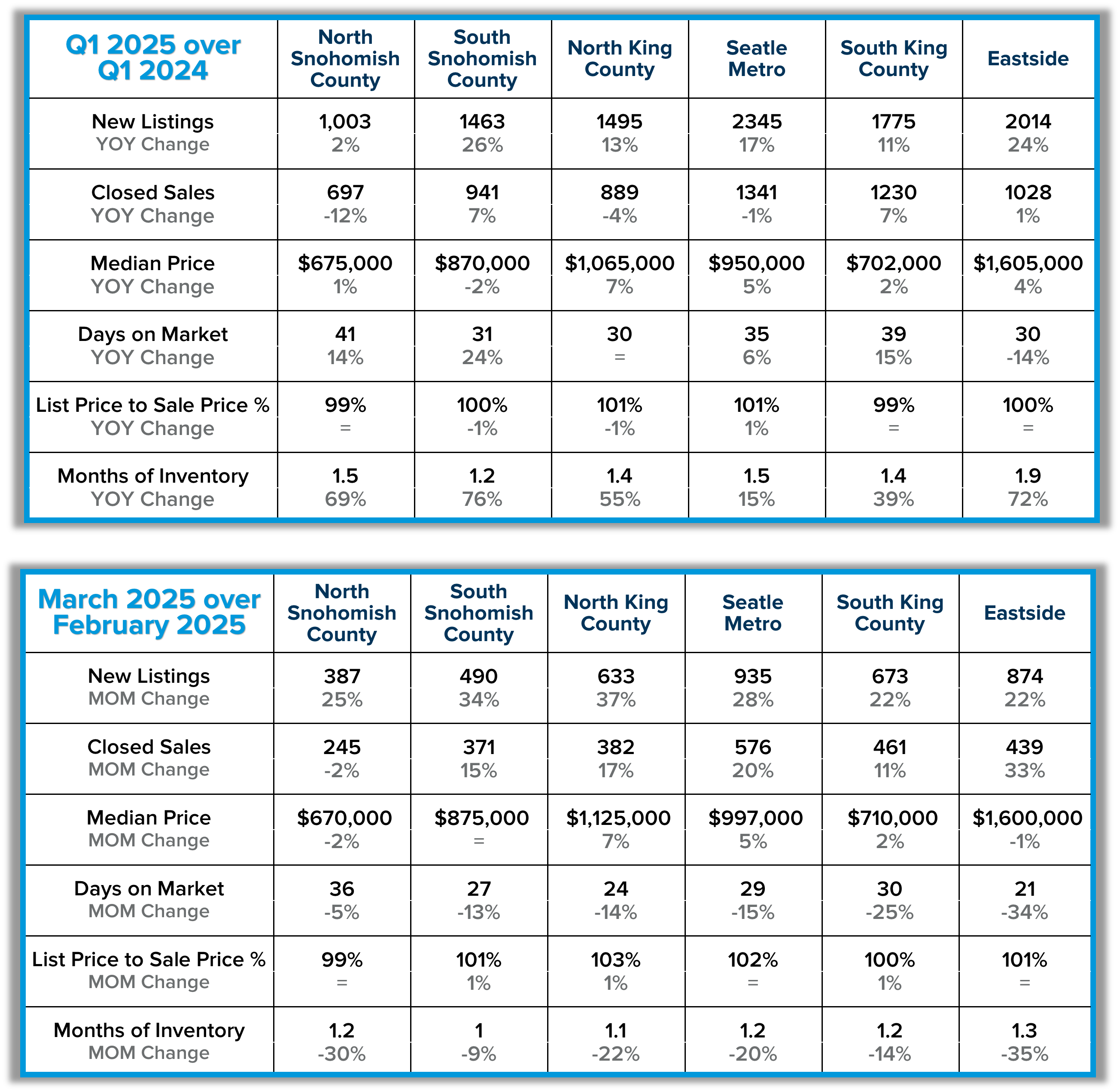

As we head into Q2, I wanted to review preliminary Q1 stats in order to report the latest trends in the market. The spring market has sprung, and activity is positive on both the seller and buyer side. The two charts above show key market factors from two points of view, March 2025 over February 2025 (Month over Month, MOM) and Q1 2025 over Q1 2024 (Year over Year, YOY). By looking at MOM, you can see the real-time progression of activity as we head into the busiest time of year in the real estate market, and the YOY look compares how 2025 is starting in comparison to 2024.

As we head into Q2, I wanted to review preliminary Q1 stats in order to report the latest trends in the market. The spring market has sprung, and activity is positive on both the seller and buyer side. The two charts above show key market factors from two points of view, March 2025 over February 2025 (Month over Month, MOM) and Q1 2025 over Q1 2024 (Year over Year, YOY). By looking at MOM, you can see the real-time progression of activity as we head into the busiest time of year in the real estate market, and the YOY look compares how 2025 is starting in comparison to 2024. MOM new listings made a big jump up, days on market are shrinking, list-to-sale price ratios are slightly rising, and prices are maintaining and appreciating. Inventory remains tight despite the increase in new listings, with all six market areas sitting at a Seller’s Market (0-2 months of inventory). This indicates strong buyer demand that is absorbing the selection despite the slow decline in interest rates. We anticipate a strong spring market with more opportunity than 2024 provided for buyers, which is a welcome change.

MOM new listings made a big jump up, days on market are shrinking, list-to-sale price ratios are slightly rising, and prices are maintaining and appreciating. Inventory remains tight despite the increase in new listings, with all six market areas sitting at a Seller’s Market (0-2 months of inventory). This indicates strong buyer demand that is absorbing the selection despite the slow decline in interest rates. We anticipate a strong spring market with more opportunity than 2024 provided for buyers, which is a welcome change. You’re invited to our annual Paper Shredding Event & Food Drive. We partner with

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with  Join me on May 7th for a live webinar with a panel of experienced insurance professionals who will share their insights and knowledge about today’s ever-changing homeowners insurance market. In the wake of several natural disasters, including the LA fires, the insurance landscape is quickly changing, and being informed will help you protect your biggest asset!

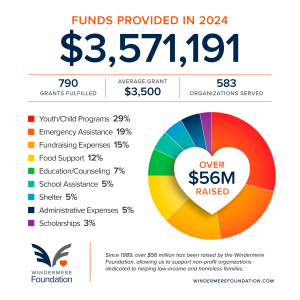

Join me on May 7th for a live webinar with a panel of experienced insurance professionals who will share their insights and knowledge about today’s ever-changing homeowners insurance market. In the wake of several natural disasters, including the LA fires, the insurance landscape is quickly changing, and being informed will help you protect your biggest asset! Big impact, bigger hearts. Thanks to our generous network, the Windermere Foundation distributed over $3.57 million in 2024, reaching a total of $56 million in donations!

Big impact, bigger hearts. Thanks to our generous network, the Windermere Foundation distributed over $3.57 million in 2024, reaching a total of $56 million in donations!

Last month, my office invited a panel of insurance professionals to discuss the volatility of the Homeowner’s Insurance (HOI) market so we could learn the latest to best inform our clients. In the wake of several natural disasters, the LA Fires is one of the most recent, HOI companies have become much more scrutinous and expensive. The increase in natural disasters such as flooding, wildfires, hurricanes, earthquakes, landslides, tornadoes, and extreme cold snaps have accelerated losses and depleted their recovery funds. This has caused carriers to increase premiums, limit coverage, and, in some cases, cancel policies.

Last month, my office invited a panel of insurance professionals to discuss the volatility of the Homeowner’s Insurance (HOI) market so we could learn the latest to best inform our clients. In the wake of several natural disasters, the LA Fires is one of the most recent, HOI companies have become much more scrutinous and expensive. The increase in natural disasters such as flooding, wildfires, hurricanes, earthquakes, landslides, tornadoes, and extreme cold snaps have accelerated losses and depleted their recovery funds. This has caused carriers to increase premiums, limit coverage, and, in some cases, cancel policies.

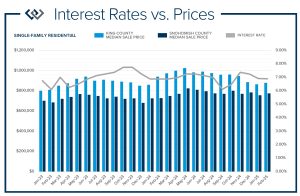

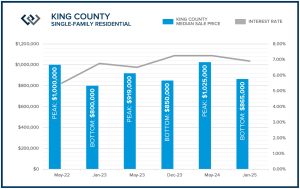

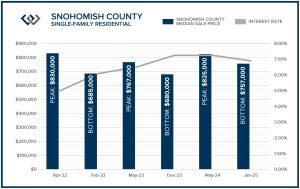

As we start a new year, I am often asked where home prices are headed. While I don’t have a crystal ball, I study the market trends and activity closely. Many aspects affect home prices, such as the overall economy’s health, inventory levels (supply & demand), and interest rates. Seasonality is also a pattern I pay close attention to, and we are headed into the time of year when we see most of the annual price growth happen. As we prepare for the Spring market, I have pulled some data that shows the seasonal patterns and the impact interest rates have had on prices, and long-term equity growth.

As we start a new year, I am often asked where home prices are headed. While I don’t have a crystal ball, I study the market trends and activity closely. Many aspects affect home prices, such as the overall economy’s health, inventory levels (supply & demand), and interest rates. Seasonality is also a pattern I pay close attention to, and we are headed into the time of year when we see most of the annual price growth happen. As we prepare for the Spring market, I have pulled some data that shows the seasonal patterns and the impact interest rates have had on prices, and long-term equity growth.

On January 22, my office hosted renowned economist and housing market specialist

On January 22, my office hosted renowned economist and housing market specialist  The

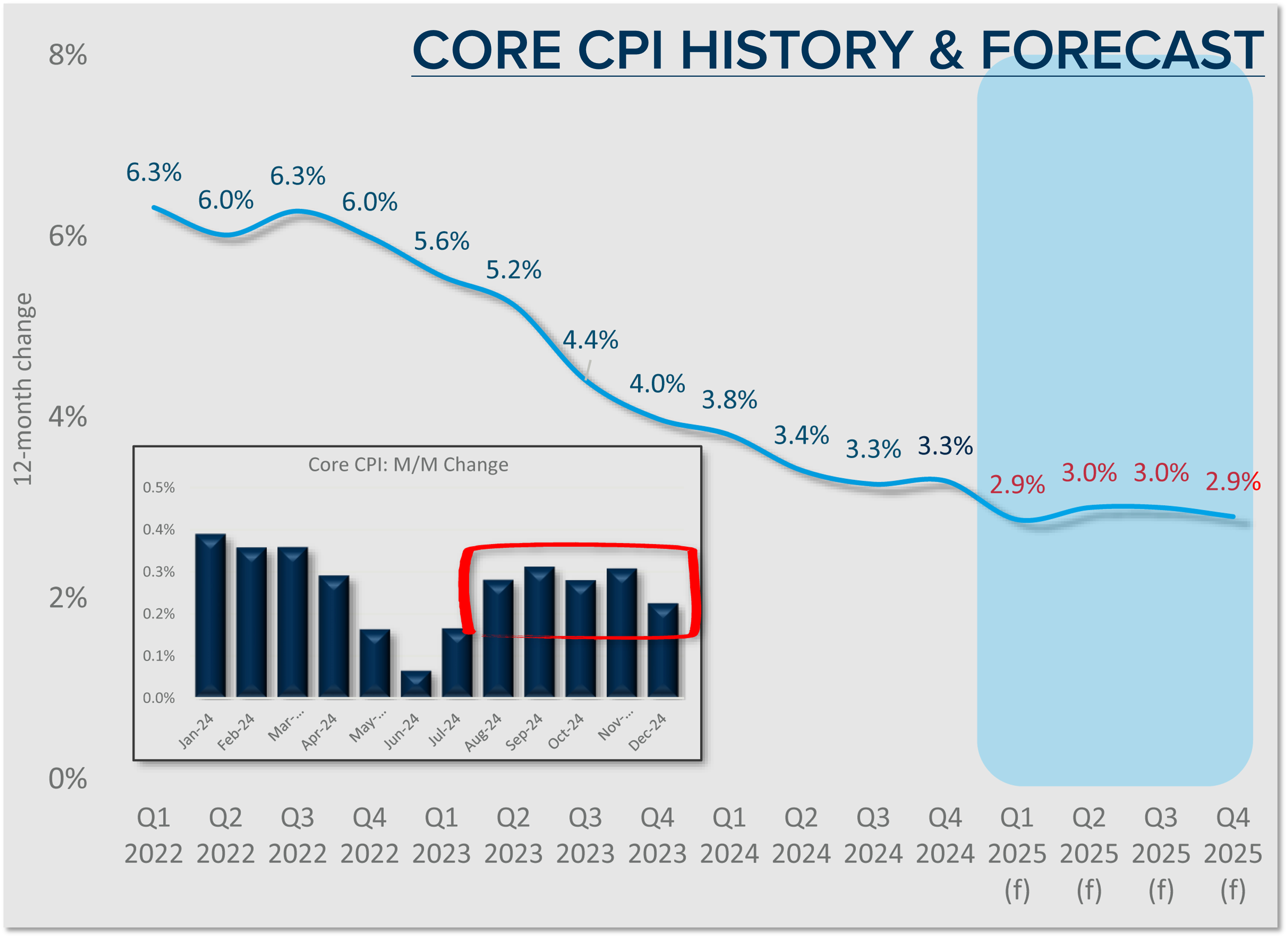

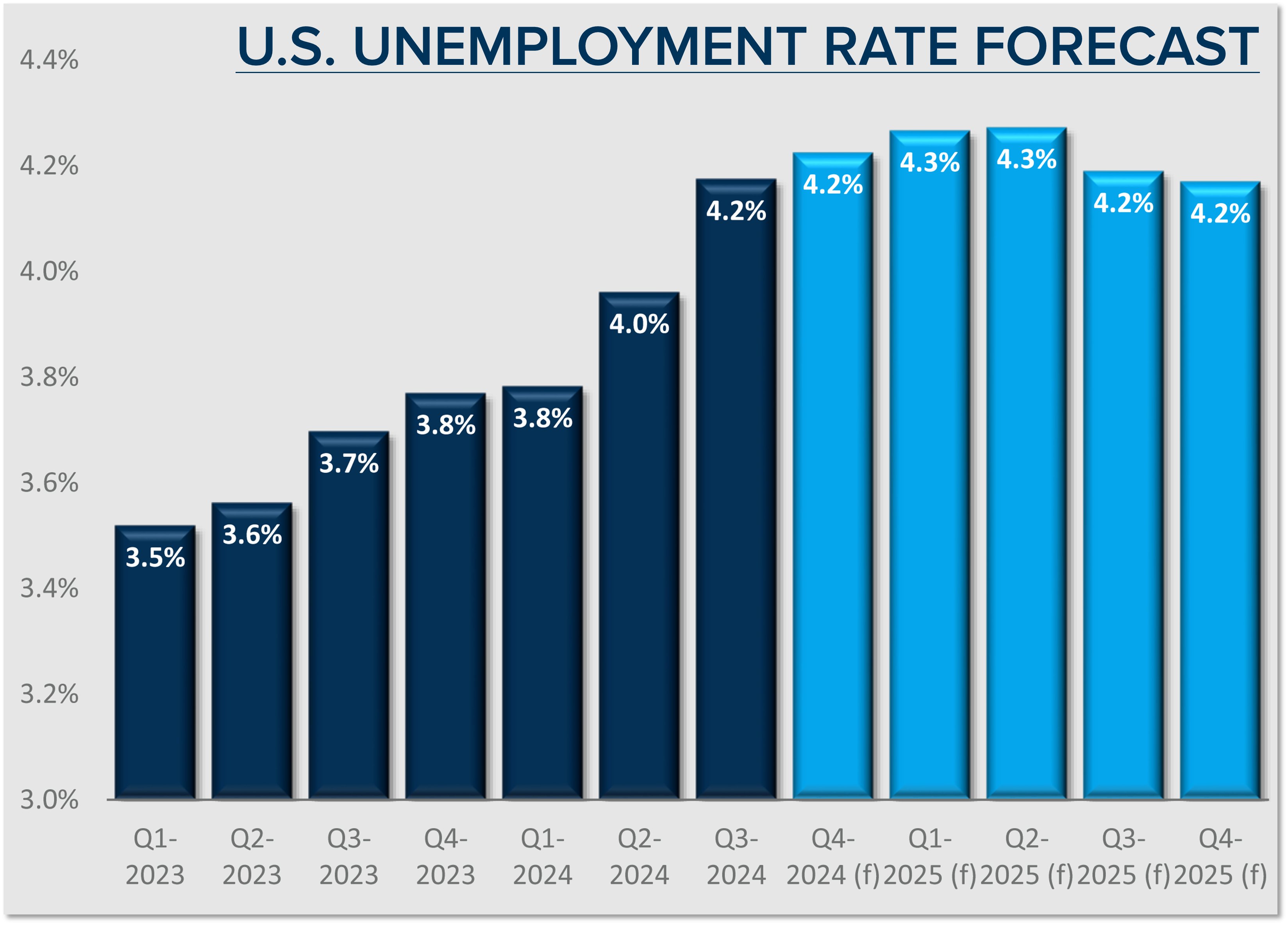

The  There is no sign of a recession. The balance of inflation, rates, and the overall health of the economy has created a soft landing that avoided a recession. In fact, GDP is up by 2% and the textbook definition of a recession is when the GDP decreases over two successive quarters.

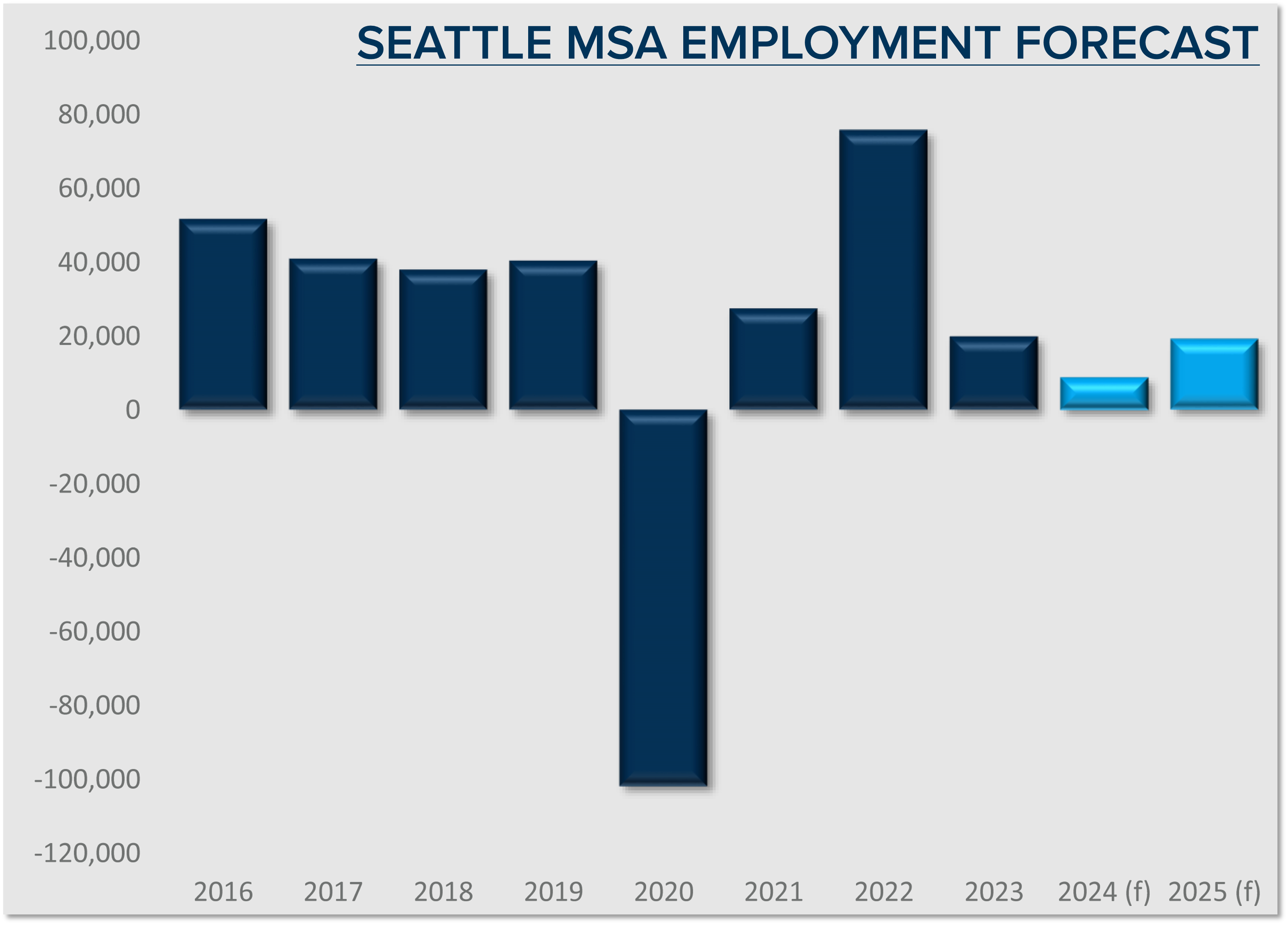

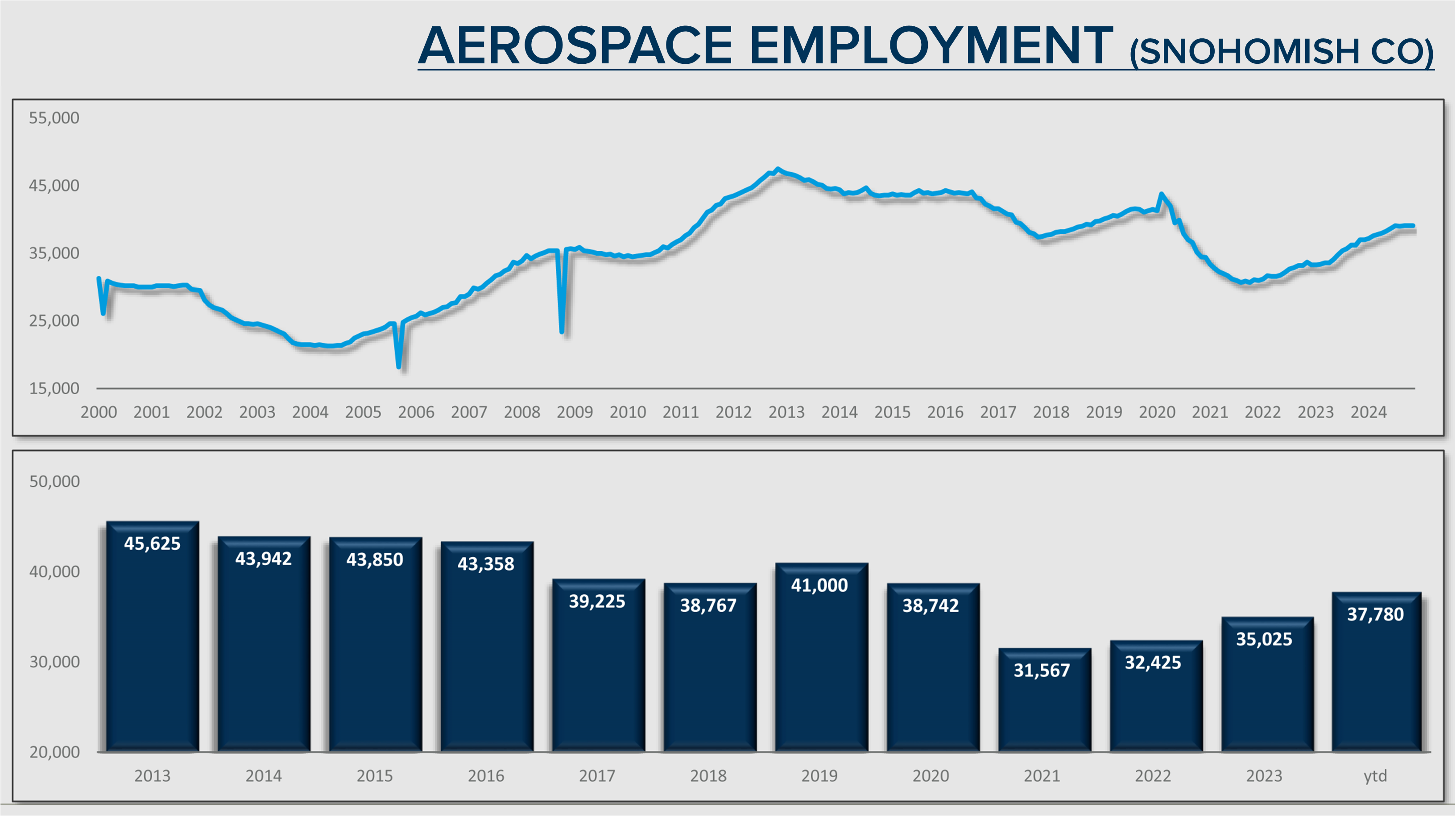

There is no sign of a recession. The balance of inflation, rates, and the overall health of the economy has created a soft landing that avoided a recession. In fact, GDP is up by 2% and the textbook definition of a recession is when the GDP decreases over two successive quarters. ✅ GREATER SEATTLE AREA JOB MARKET:

✅ GREATER SEATTLE AREA JOB MARKET:

✅ GREATER SEATTLE HOUSING MARKET:

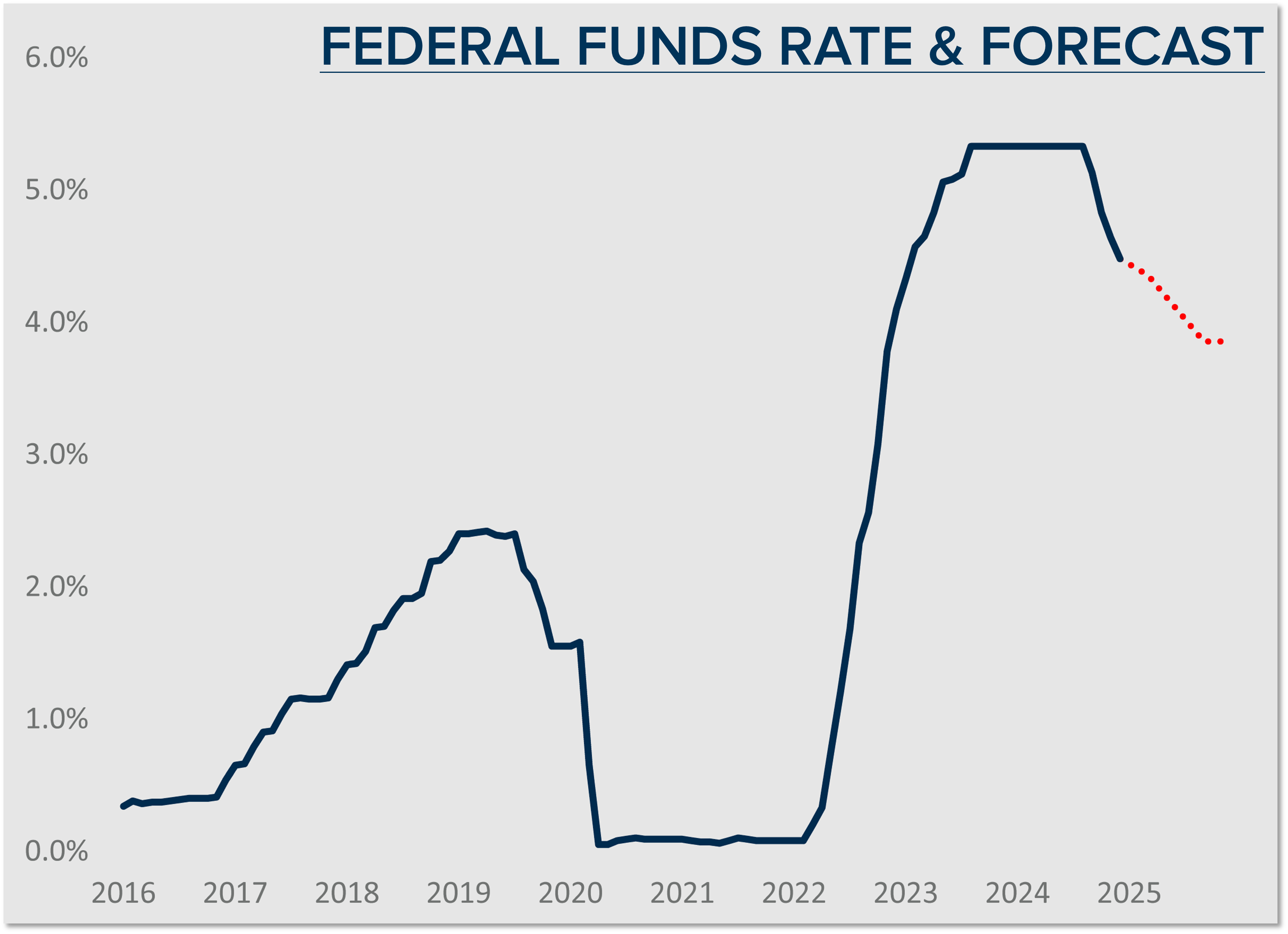

✅ GREATER SEATTLE HOUSING MARKET: Mortgage rates will modestly decrease throughout 2025 and should end up in the low 6%. The biggest headwind is deficit spending now that inflation has settled. This spending will keep the 10-year treasury high, which will have a direct impact on mortgage rates. These are two key factors to watch if you’re waiting for mortgage rates to drop significantly.

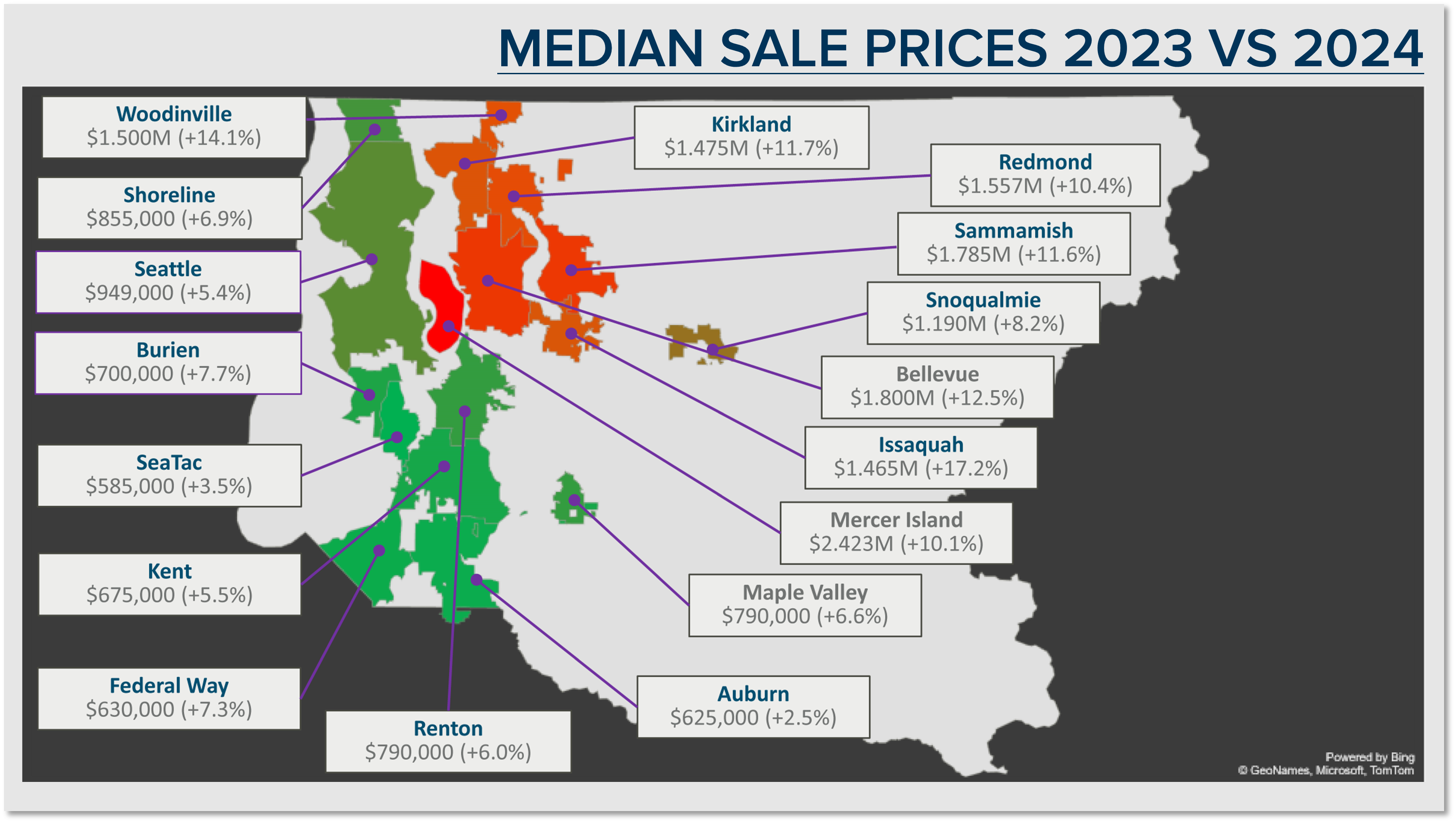

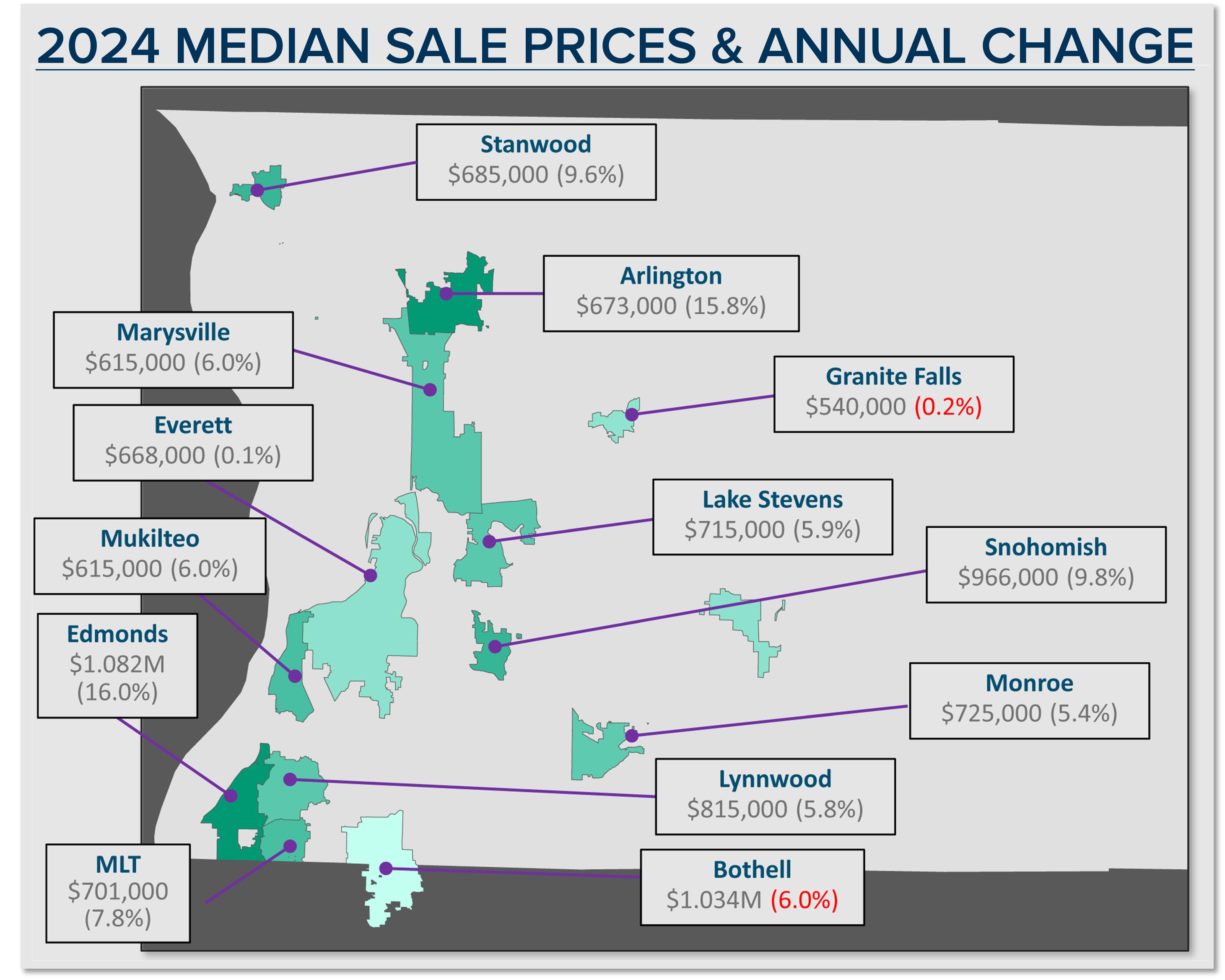

Mortgage rates will modestly decrease throughout 2025 and should end up in the low 6%. The biggest headwind is deficit spending now that inflation has settled. This spending will keep the 10-year treasury high, which will have a direct impact on mortgage rates. These are two key factors to watch if you’re waiting for mortgage rates to drop significantly. Prices increased in King and Snohomish counties in 2024 and are expected to grow again in 2025 despite stubborn mortgage rates. In King County, inventory was up by 10%, sales were up 12%, and the median price was up 10.7% year-over-year. Price growth is predicted to increase by 4% in 2025, which is higher than the historical national annual average. In Snohomish County, inventory was up by 17%, sales were up 8%, and the median price was up 9.9% year-over-year. Price growth is predicted to increase by 5% in 2025.

Prices increased in King and Snohomish counties in 2024 and are expected to grow again in 2025 despite stubborn mortgage rates. In King County, inventory was up by 10%, sales were up 12%, and the median price was up 10.7% year-over-year. Price growth is predicted to increase by 4% in 2025, which is higher than the historical national annual average. In Snohomish County, inventory was up by 17%, sales were up 8%, and the median price was up 9.9% year-over-year. Price growth is predicted to increase by 5% in 2025.

Affordability is the biggest challenge. With price growth steady coupled with higher interest rates, monthly payments have grown faster than incomes. This has put first-time homebuyers at a disadvantage in core job center locations. Down payment assistance (gift funds) from family and/or high-paying salaries in the tech, biotech, and big corporate companies have differentiated the ability of some first-time homebuyers compared to others with limited down payment funds and higher debt-to-income ratios.

Affordability is the biggest challenge. With price growth steady coupled with higher interest rates, monthly payments have grown faster than incomes. This has put first-time homebuyers at a disadvantage in core job center locations. Down payment assistance (gift funds) from family and/or high-paying salaries in the tech, biotech, and big corporate companies have differentiated the ability of some first-time homebuyers compared to others with limited down payment funds and higher debt-to-income ratios. This is certainly a lot to unpack as we head into 2025. Stay tuned for even more insights on what we learned from Matthew in my next newsletter. In the meantime, I am here to encourage you and point out that this is a lot of good news. We look forward to more moderate growth in 2025, which is good. Severe increases are not healthy. While we are combating an affordability crisis, the steady wave of moderation on top of incredibly high equity levels should play out to create a stable and fruitful 2025 real estate market.

This is certainly a lot to unpack as we head into 2025. Stay tuned for even more insights on what we learned from Matthew in my next newsletter. In the meantime, I am here to encourage you and point out that this is a lot of good news. We look forward to more moderate growth in 2025, which is good. Severe increases are not healthy. While we are combating an affordability crisis, the steady wave of moderation on top of incredibly high equity levels should play out to create a stable and fruitful 2025 real estate market.

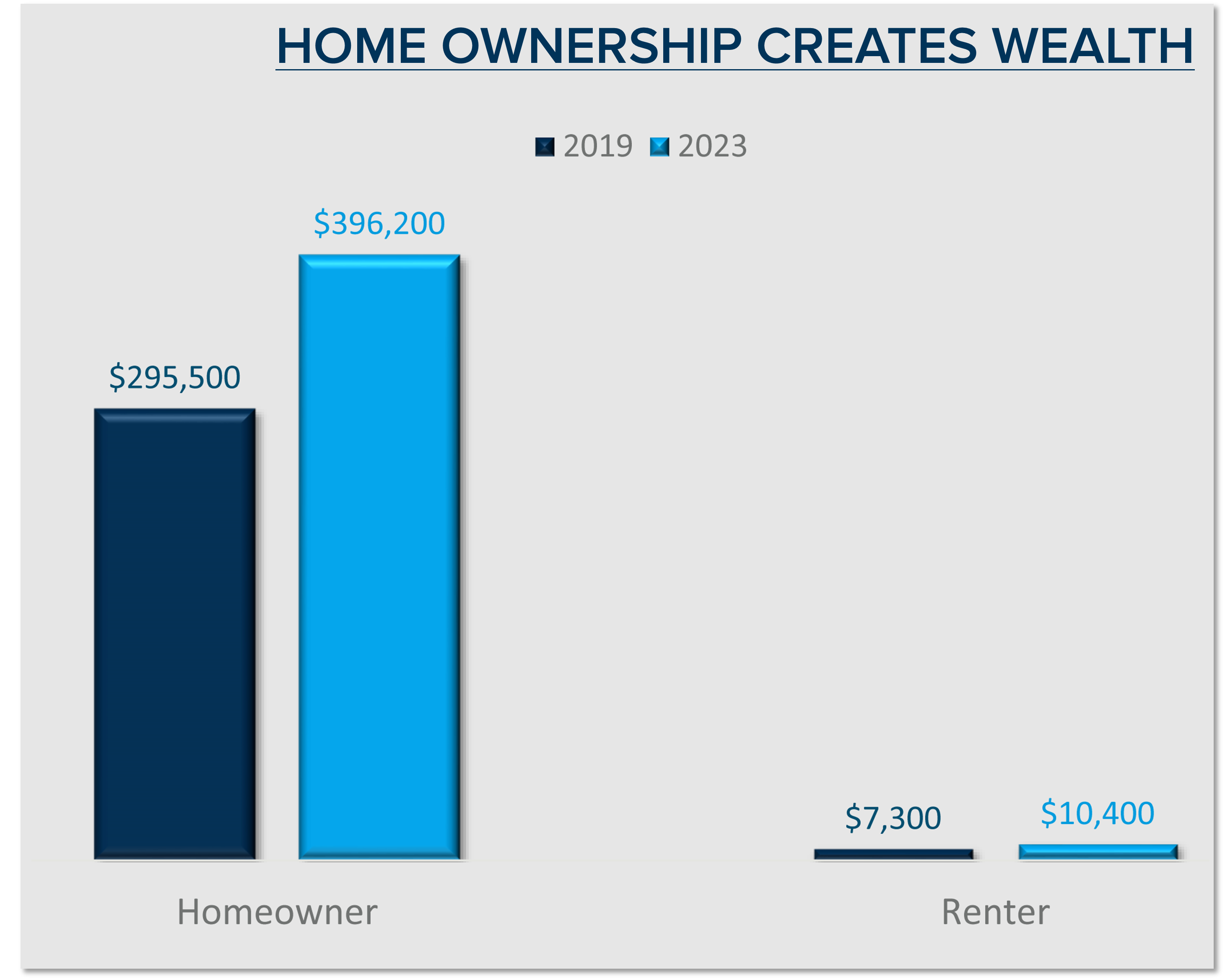

As we head into the holidays and mark the final stretch of the year, I wanted to report on the 2024 real estate market and where we might be headed in 2025. To set the stage, I must mention the ride that it has been over the last five years. Since 2019, we have experienced some key market factors that have influenced market activity and prices.

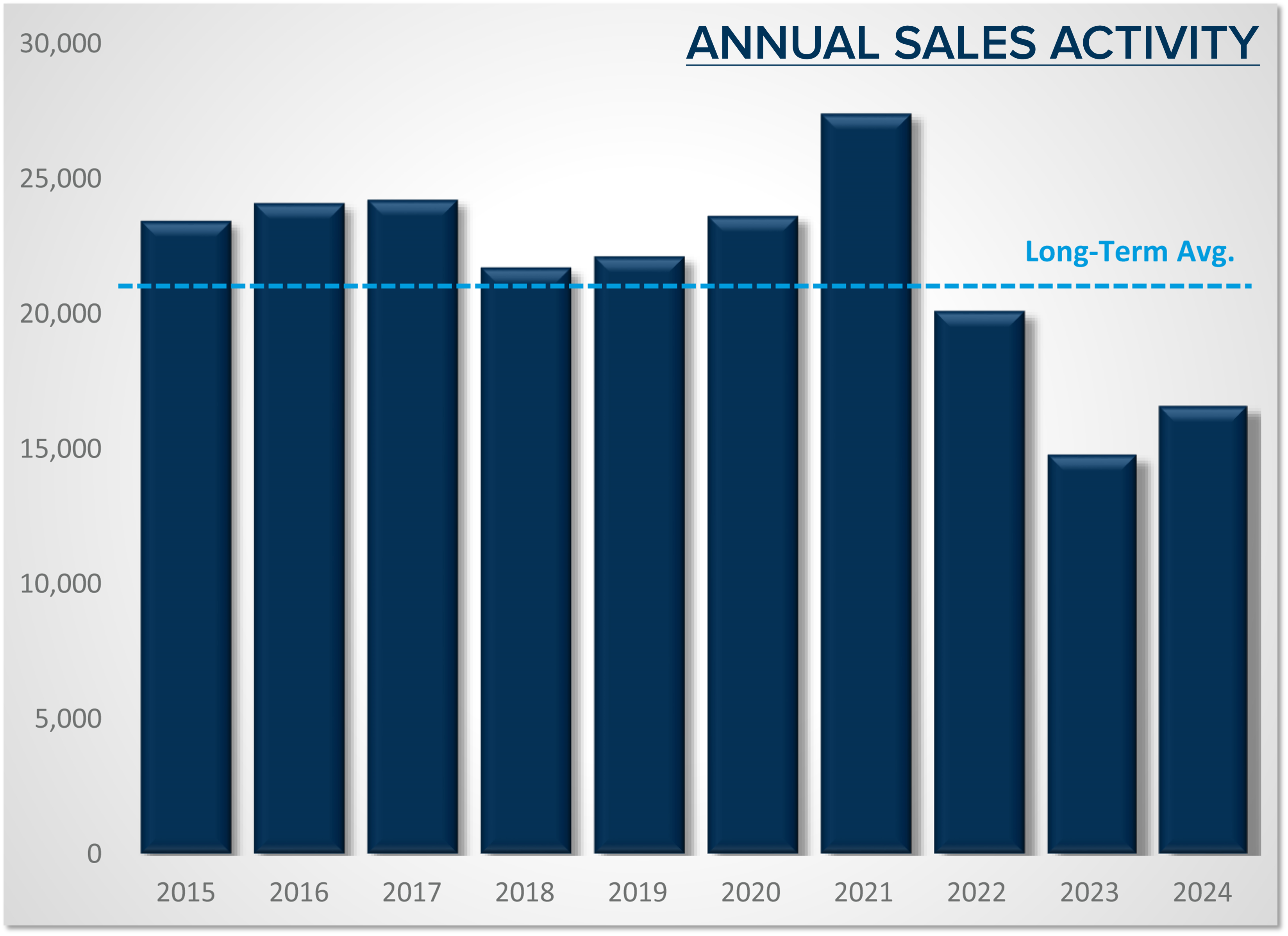

As we head into the holidays and mark the final stretch of the year, I wanted to report on the 2024 real estate market and where we might be headed in 2025. To set the stage, I must mention the ride that it has been over the last five years. Since 2019, we have experienced some key market factors that have influenced market activity and prices. After reviewing the last 10 years of closed sales, we are down about 25% YTD in King County and 30% in Snohomish County from a normal average closed sales rate. This has remained stubborn due to the lock-in effect that the previous low rates have created. For example, many homeowners who purchased or re-financed to obtain a rate of 3-4% are holding tight to their monthly payments. This has caused many people to stay in homes that don’t ideally fit their lifestyle due to wanting to keep the monthly payment and overall affordability.

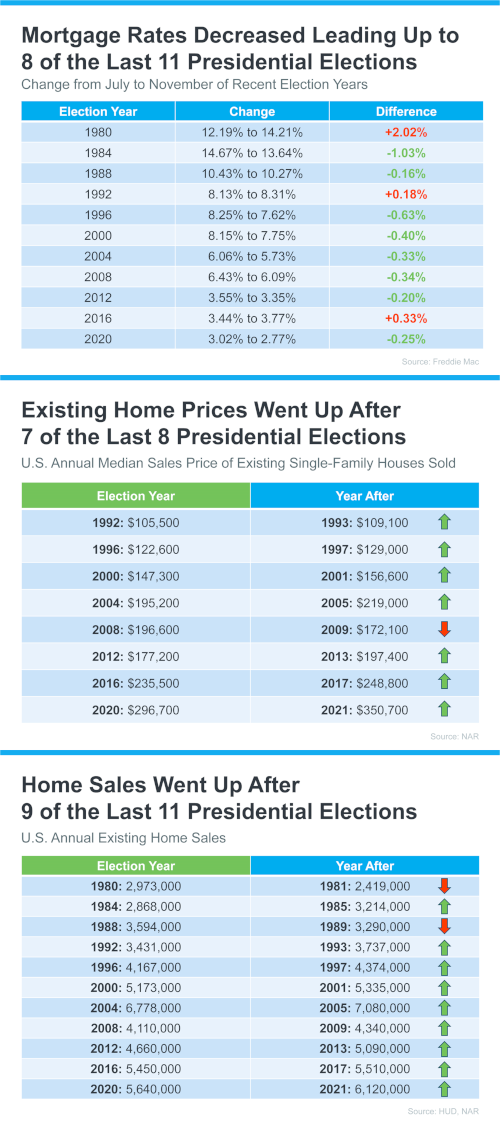

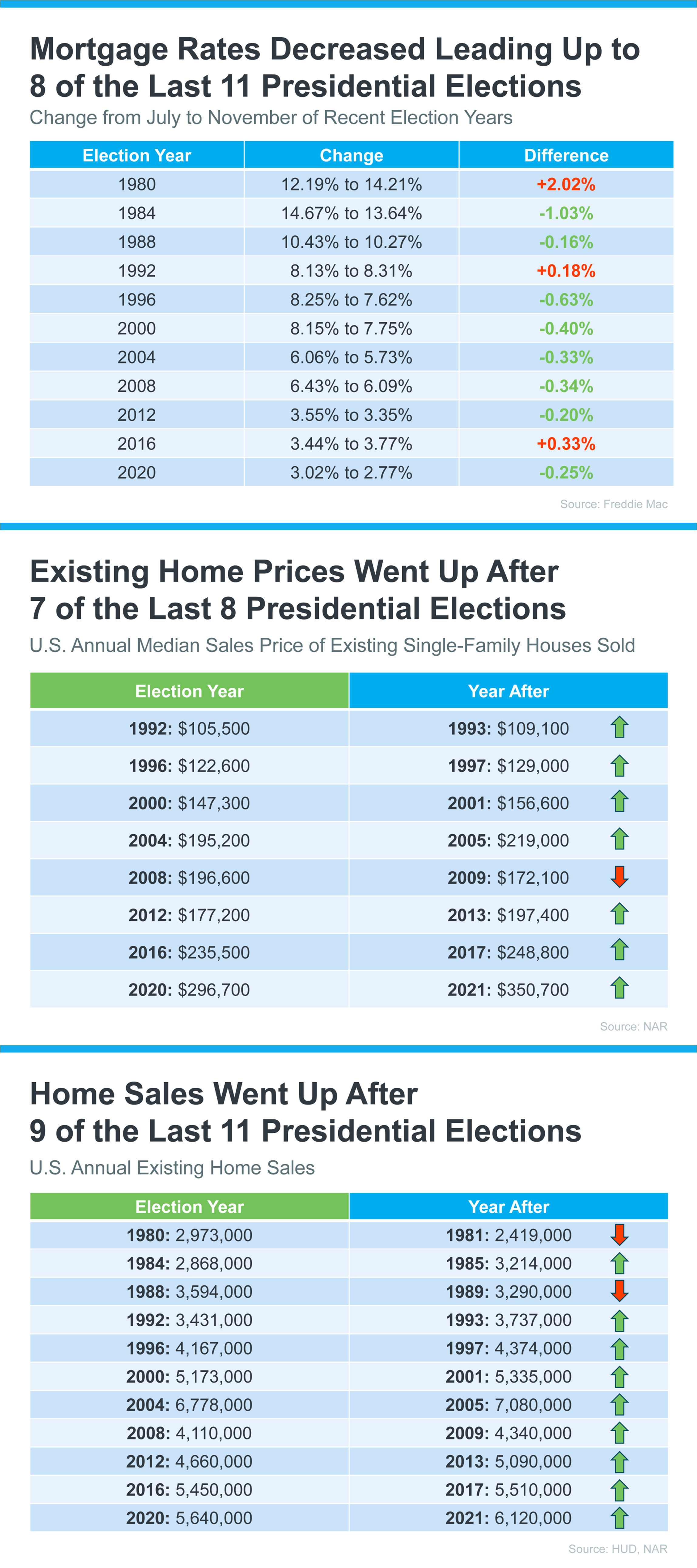

After reviewing the last 10 years of closed sales, we are down about 25% YTD in King County and 30% in Snohomish County from a normal average closed sales rate. This has remained stubborn due to the lock-in effect that the previous low rates have created. For example, many homeowners who purchased or re-financed to obtain a rate of 3-4% are holding tight to their monthly payments. This has caused many people to stay in homes that don’t ideally fit their lifestyle due to wanting to keep the monthly payment and overall affordability. Another aspect to point out is the trends we typically see in post-election years. Historical data indicates increased closed sales, lower interest rates, and price growth. This data, coupled with pent-up seller demand and gradually decreasing interest rates, should drive sales to increase slightly and prices to appreciate and remain stable. Most homeowners are sitting on well-established equity, enabling them to make fluid moves.

Another aspect to point out is the trends we typically see in post-election years. Historical data indicates increased closed sales, lower interest rates, and price growth. This data, coupled with pent-up seller demand and gradually decreasing interest rates, should drive sales to increase slightly and prices to appreciate and remain stable. Most homeowners are sitting on well-established equity, enabling them to make fluid moves. If you or someone you know is considering buying, selling, or both, now is a great time to reach out. Executing a purchase and/or sale and a move takes strategic planning to achieve the best outcome. I love helping my clients identify their goals, curate a detailed list of items to create the ideal results, and help guide the process to a successful finish. A new year brings a fresh start, and why not start to verbalize, visualize, and start your planning now, whether your goals are immediate or in the distant future? Please use me as your real estate resource, as my goal is to be your trusted advisor rooted in data and market education.

If you or someone you know is considering buying, selling, or both, now is a great time to reach out. Executing a purchase and/or sale and a move takes strategic planning to achieve the best outcome. I love helping my clients identify their goals, curate a detailed list of items to create the ideal results, and help guide the process to a successful finish. A new year brings a fresh start, and why not start to verbalize, visualize, and start your planning now, whether your goals are immediate or in the distant future? Please use me as your real estate resource, as my goal is to be your trusted advisor rooted in data and market education.

cookies. Think of it as a delectable combo of shortbread and a Snickerdoodle.

cookies. Think of it as a delectable combo of shortbread and a Snickerdoodle.