2022 has been an eventful year in the real estate market and the economy. After 2 years of pandemic-fueled demand and historically low interest rates, we experienced a shift. The Fed quickly raised rates (by 2 points) from April to October to combat inflation, curbing buyer demand as affordability took a hit. The overall economy is starting to settle back to pre-pandemic levels and the second half of 2022 was the time that was needed to make this adjustment.

We have recently seen rates drop as year-over-year inflation numbers start to show improvement. We anticipate this trend to continue slowly but surely as we head into 2023 and beyond. The upward trend in rates has put downward pressure on prices, but they are starting to stabilize as the new normal sets in. Price appreciation is still up year-over-year when you look at the average of the last 12 months and compare them to the previous 12 months, and certainly over the last 3-10 years as a whole.

We started 2022 at 3.5%, peaked at just over 7%, and now find rates in the mid-6%. Experts like Matthew Gardner are anticipating rates to settle in the high 5% sometime in 2023, which would be 2 points below the historical average. Currently, buyers are enjoying more favorable negotiations and are securing sale prices that are not escalating at a feverish pitch.

Some buyers are getting creative and using seller credits for a rate buy-down, some are securing adjustable-rate mortgages, and some just plan to re-finance when rates come down further next year. It is important for buyers to understand that as rates come down prices will start to fortify again.

Besides rates and prices, which are related, two additional factors to pay attention to are our local job market and estimating the recession. We have recently experienced some layoffs in our region, particularly in the tech sector. See the video from Matthew Gardner here which speaks to this. The bottom line is over 20,000 jobs were added in the information sector during the pandemic, and that number is now receding. Just like prices grew exponentially during the pandemic, so did many other aspects of the economy and everything is finding its equilibrium as we return to our new normal. Bear in mind, there are other sectors of our local job market that are growing.

Besides rates and prices, which are related, two additional factors to pay attention to are our local job market and estimating the recession. We have recently experienced some layoffs in our region, particularly in the tech sector. See the video from Matthew Gardner here which speaks to this. The bottom line is over 20,000 jobs were added in the information sector during the pandemic, and that number is now receding. Just like prices grew exponentially during the pandemic, so did many other aspects of the economy and everything is finding its equilibrium as we return to our new normal. Bear in mind, there are other sectors of our local job market that are growing.

I’d like to leave you with two pieces of advice as we head into 2023 and are forced to jump on the media roller coaster of their reporting economic and real estate news. Pay attention to long-term figures and understand that real estate is a lifestyle move, not just a financial chess move.

The media will paint the picture that the sky is falling and it simply is not. The recession is predicted to be short, much like the recession of 1990-91. Some economists are claiming that we are already through the worst of it. This will be nothing like the Great Recession of 2007-2012, nothing! It just happens to be the one closest in our rear-view mirror and easiest to recall, but that was made up of entirely different factors that do not compare to our current environment. Please reach out if you’d like to further discuss the differences.

We are not headed toward a bubble in the real estate market. Homeowner equity is incredibly strong with over 50% of all homeowners in WA state having over 50% home equity. Homes are not foreclosed on when there is equity—period, end of story. As numbers are reported in the first half of 2023 they will be compared to the peak prices of 2022 and those numbers will create negative headlines. We will spend the first half of 2023 adjusting off of those peaks, but where I am sure the media will fall short is reporting the overall growth in values since 2019.

Real estate is a long-term hold investment, it always has been. The ramp-up of the pandemic years may have clouded that long-term truth, but I can assure you double-digit and certainly 20%+ annual appreciation is not normal. The historical norm is 3-5% annually.

For example, in Snohomish County when you take the last 12 months of median price and average it and compare it to the previous 12 months, prices are up 15%. When you take the median price in Nov 2022 and compare it to the median price in Nov 2021, prices are up 3%. Further, when you take the median price in Nov 2022 and compare it to the median price two years ago in Nov 2020, prices are up 22%. We are experiencing a correction off of the peak, not a tumbling of long-term values. Hence, why there is no bubble.

In fact, experts are anticipating that we end 2023 with positive, yet slight year-over-year appreciation. This is more reflective of historical norms and much calmer than the intense pandemic-fueled years that were inflated with rates that we will quite possibly never see again in our lifetime.

Lastly and most importantly, real estate moves are most often motivated by life changes. Job changes, familial changes, and financial shifts lead to people changing their housing and location. These big life changes are delicate and exciting, and require strategic planning and care. I am all about helping my clients obtain successful financial results, but I am also committed to helping my clients navigate the details, challenges, emotions, and logistics of a move. I always approach the process with the end in mind, but also with the journey prioritized to be smooth and enjoyable.

I hope you call on me when your curiosity is piqued or you have an emergent need in your world related to real estate. I take pride in understanding the latest trends and helping you apply them to your goals. Also, if you know of anyone that needs real estate help, please pass my name along or get me in touch with them. Your people are my people, and helping them stay well-informed to empower strong decisions is my mission. As we encounter change and recalibrate, this expertise will be more important than ever; I am honored to have your trust and endorsement.

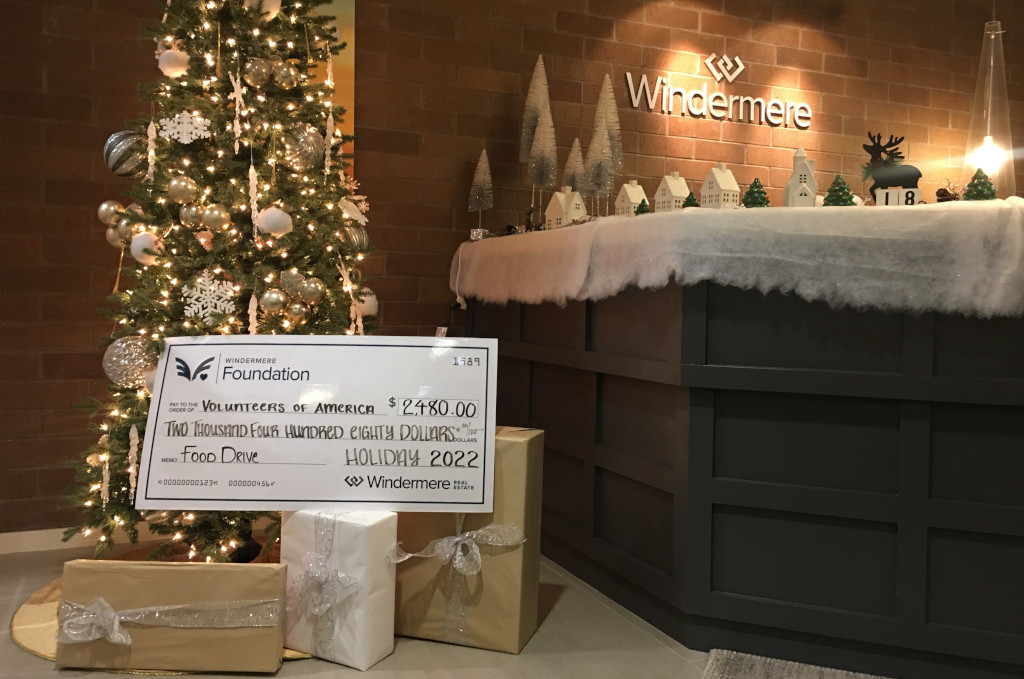

Holiday Events = Holiday Giving

at Windermere North

We have been busy at our office holding various holiday events that have included the opportunity to give back to the local food banks through holiday food drives. When we bring people together to celebrate it is also a priority to weave in giving back to our community. When we do this, we are always thrilled to partner with Volunteers of America of Snohomish County who support various food banks and food pantries across the county. Just this week, VOA picked up a total of 1,820 pounds of food and $2,480 that resulted from our holiday events.

With inflation still high, food insecurity is prevalent making these food drives an easy choice to direct our giving. If you are looking for a way to give back this holiday season, please reach out to VOA. They are a trusted local organization that will make sure your donation is placed to benefit those in need.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link